- Abstract:

- 1. INTRODUCTION

- 2. LITERATURE REVIEW

- 3. METHODOLOGY

- 4. RESULTS AND ANALYSIS

- 5. DISCUSSION

- CONCLUSION

- PRACTICAL IMPLICATION

- THEORETICAL IMPLICATIONS

- LIMITATIONS AND FUTURE IMPLICATIONS

- AUTHOR'S CONTRIBUTION

- CONSENT FOR PUBLICATION

- AVAILABILITY OF DATA AND MATERIALS

- FUNDING

- CONFLICT OF INTEREST

- ACKNOWLEDGEMENTS

- APPENDIX A: QUESTIONNAIRE

- REFERENCES

PDF

PDF

1Al Jomaih and Shell Lubricating Oil Company Ltd. (JOSLOC), Saudi Arabia

Received: 30 May, 2025

Accepted: 15 August, 2025

Revised: 13 August, 2025

Published: 22 September, 2025

Abstract:

Aim: The study investigated the integration of SAP systems with digital taxation platforms in KSA, focusing on how such integration enables regulatory compliance, automates audit procedures, and supports sustainable fiscal governance.

Methods: The data was collected from 356 tax managers and accounting managers of various SMEs that operate in KSA and analysed through the PLS-SEM method on SmartPLS. The sample is unique as it targeted 356 tax and accounting managers of various SMEs in Saudi Arabia, thereby providing valuable insights regarding the financial practices in the fast-evolving regulatory environment.

Findings: It was found that the integration of the SAP system and tax reporting played an important role in tax compliance. Nevertheless, e-invoicing did not affect the tax compliance. It was also shown that the cost of tax reporting and e-invoicing significantly influenced the audit automation; but the SAP system integration was insignificant. SAP integrations on e-invoicing tax reporting were a major influence on fiscal governance.

Implications: The results focused on the necessity of specific strategies related to regional problems of digital transformation and contributed to a high level of correspondence between technological measures and organisational preparedness in KSA.

Keywords: SAP integration, audit automation, tax reporting, tax compliance, e-invoicing, sustainable fiscal governance.

1. INTRODUCTION

The Kingdom of Saudi Arabia (KSA) is progressing technologically and economically on the agenda of Vision 2030, the core of which is the diversification of the economy and the improvement of the government’s functioning (Olaopa & Alsuhaibany, 2023). According to (Al-Otaibi et al., 2024), the essence of its transformation is to modernise its tax system to ensure sustainable fiscal management and optimise public revenues. Therefore, to achieve these goals, the integration of Systems and Applications, and Products in Data Processing (SAP) with digital government portals has become extremely important (Kulkarni, 2024). According to (Ghulaxe, 2024), SAP, one of the foremost Enterprise Resource Planning (ERP) software packages, can automate and streamline financial and operational processes in organisations, including tax compliance processes. In parallel, (Altawyan, 2023) discussed that KSA’s tax department, Zakat, Tax and Customs Authority (ZATCA), has made considerable investments in digital transformation through imposing electronic invoicing (Fatoora) and real-time reporting of taxes to increase transparency, precision, and compliance.

The alignment of SAP systems with the digital platforms of ZATCA holds significant advancements for drastic improvements in automating tax workflow processes. As per (Elsharnouby, 2024; and Luz et al., 2024) the integration reduces manual intervention, lowers the risk of errors, expedites audit procedures, and facilitates seamless interactions between taxpayers and the government. However, (Shekhar, 2023) argued that the operationalisation of such integration necessitates overcoming technical, organisational, and regulatory hurdles. While SAP provides standardised tax modules, adapting them to the specific tax legislation and digital mandates of KSA necessitates careful customisation and compliance validation (Escap, 2022).

The implementation of the digital tax platform in KSA and the integration of SAP with the digital tax platform have challenges and opportunities that are different from those projects implemented in developed economies. Unlike the OECD’s tax administrations, which are well developed and usually utilise the power of Artificial Intelligence (AI) in performing fraud detection tasks, risk evaluation, and others, the KSA tax system is only in its early stages in this way. As per (OECD, 2025), 72% of tax management bodies in the OECD use AI, whereas its implementation in KSA is inadequate, which may be attributed to the lack of resources and uniquely proposed solutions that can be adopted to fit local taxation rules and requirements to digitalisation. In a similar way, the Inland Revenue Authority of Singapore has encouraged software providers to integrate tax APIs into their system to make tax filing an automatic process (SCTP, 2024). These initiatives draw attention to the highly developed digital infrastructure of developed nations, a model that is implemented in KSA. Nonetheless, the swift dynamics of regulatory transformations in KSA, such as numerous revisions of VAT and Zakat regulations, will require the constant updating and adjusting of integrated systems, which is a challenge not seen in more solid regulatory regimes.

The broader context for this integration initiative lies within the growing emphasis on worldwide focus on digital taxation and e-governance. According to (Abdul Rashid & Ramli, 2024), governments across the globe are embracing digital technology to make tax administration more efficient, eliminate tax evasion, and promote sustainable fiscal governance. KSA’s strategy of leveraging globally accepted SAP technology alongside bespoke government digital platforms provides a compelling research area on how emerging economies can advance conventional tax systems to move towards digitally powered fiscal governance. However, the theoretical and practical appreciation of the intricacies, consequences, and best practices of SAP and digital tax platform integration in KSA is scarce, demanding systematic research.

Despite the evident strategic benefits of integrating SAP with digital tax systems in KSA, there is a significant knowledge gap in the implementation of operational, technical, and organisational hurdles. As per (Yordanova, 2024), organisations struggle to map SAP modules with the constantly evolving legislation needs of ZATCA, particularly considering frequent VAT regulation updates, Zakat computations, and e-invoicing requirements. Such challenges lead to compliance risk, higher manual interventions, and inefficiencies in auditing procedures (Parimi, 2019). Furthermore, the available literature does not encompass thorough empirical research on the efficiency of such combined systems toward improving tax compliance and audit automation under the specific Saudi context. The majority of available literature, for instance by (Medfouni, 2024), focuses on SAP implementation on revenue collection and tax evasion, failing to comprehensively address the integration of challenges of digital tax platforms and their broader impact on the audit automation and sustainable fiscal governance in the context of KSA. Such a disjointed information base prevents policymakers and practitioners from realising the full potential of digital taxation reforms (Gulzar et al., 2024; Sarwar et al., 2024). However, the study by (Medfouni, 2024) overlooked the integration challenges with tax digital platforms and their broader effects on audit automation and sustainable governance. Moreover, in KSA, SAP integration with the digital tax portal ZATCA poses large challenges like frequent government updates, e.g., VAT and Zakat amendments, and system customisation to support local taxation laws. In addition, institutional readiness and digital infrastructure shortages also offer challenges to successful implementation. This study fills the research gap by analysing the impact of SAP integration within the context of the evolving tax system of KSA, offering insights for policymakers and regional organisations.

The swift economic transformation of Saudi Arabia through the Vision 2030 is also characterised by major improvements in the fiscal system, such as the implementation in 2018 of Value Added Tax (VAT) at 5%, which was raised to 15% in 2020 to improve governmental revenues during oil price volatility periods (Almohaimeed, 2021). This transition was a breakaway from the historical reliance of the Kingdom on oil earnings and the lack of individual income tax, and it followed the greater vision leaders foresaw to diversify the economy and increase financial stability through Vision 2030. Conversely, most developed economies like those in the OECD have a well-developed and stable tax regime, with a developed legacy infrastructure; hence, such rapid changes as seen in Saudi Arabia are not that prevalent. The aggressive style embodied in a rapid implementation of policies and a strong digitalisation initiative, such as the gradual adoption of the Fatoora e-invoicing system since December 2021, can be considered a thoughtful approach by the Kingdom towards the modernisation of the tax administration (OECD, 2024).

The lack of empirical data further complicates the assessment of the integration’s influence on organisational workflows, tax authority processes, and overall fiscal governance. There lies a pressing need for a study that not only captures the integration process but also critically assesses the effectiveness of the process in ensuring compliance, facilitating audit functions, and enabling fiscal sustainability. Without such insights, the risk of suboptimal technology adoption and missed policy objectives remains, threatening to disrupt KSA’s Vision 2030 aspirations. (Altawyan, 2023). Therefore, the study aims to investigate the integration of SAP systems with digital taxation platforms in the Kingdom of Saudi Arabia, focusing on how such integration enables regulatory compliance, automates audit procedures, and supports sustainable fiscal governance. The study seeks to provide theoretical insights and practical recommendations for organisations and policymakers involved in digital taxation initiatives.

The study adds to the novelty by addressing a key research gap through presenting an empirical study of SAP and digital tax platform integration in the distinctive institutional and regulatory context of KSA. In contrast to earlier studies, for instance, (Almaqtari, 2024), shed light on the IT governance role in integrating Artificial Intelligence (AI) accounting and audit operations in Saudi Arabia, failing to discuss the integration of SAP and other digital platforms on KSA taxation. In this case, the study tries to contribute to theoretical understandings relating to digitalisation in tax administration and ERP system tailoring. SAP consolidation with KSA taxation digital platforms is essential to automate financial activities, enhance the accuracy of tax reporting, and ensure conformity with changing tax laws. Consolidation is most likely to facilitate real-time data exchange, reduce human errors, and increase the effectiveness of audits. It will eventually create a more transparent, efficient, and responsive tax administration system that aligns with the Kingdom’s Vision 2030 targets for sustainable financial stewardship.

Further, the research provides novel insights into how audit automation, often discussed conceptually, operationalises in real-world settings, demonstrating its practical advantages and limitations. The inclusion of sustainable fiscal governance as a core theme broadens the agenda beyond compliance to examine long-term economic and institutional effects, responding to current demands for responsible digital governance across public sectors (Shaukat et al., 2024). In addition, the study’s findings will provide practical and actionable recommendations for corporate managers, IT experts, and tax authorities in the KSA public sectors, enabling them to overcome integration complexity and improve system efficacy. The study will also inform policymakers designing and integrating regulatory frameworks that facilitate technological development while protecting public interests.

2. LITERATURE REVIEW

The process of SAP systems integration with ZATCA digital is a complicated process involving technical, organisational, and regulatory complexity. (Yordanova, 2024) pointed out that SAP functions must be adjusted to the ever-changing tax legislation, and very detailed customisation procedures and capabilities are required to update the system, and often tax utility, internal IT resource, and third-party sourcing service are exhausted. One of the key technical issues relates to data interoperability and system compatibility. A study by (Escap, 2022) discovered that government tax portals often use proprietary standards, APIs, and validation rules that need to be seamlessly integrated with ERP data schemes to ensure proper functionality. Discrepancies in data formats, communication protocols, and timing of data exchanges may lead to synchronisation failures and reporting inaccuracies (Shekhar, 2023; Sarwar et al., 2025). (Gupta & Jain, 2024) stated that such integration complexities demand robust middleware solutions and continuous system updates, which increase the cost and time of implementation projects. Security and privacy issues further complicate the integration processes. (Elsharnouby, 2024) explored challenges of SAP implementation in the Egyptian public sector, as it was discovered that leadership and management problems, infrastructure and resources limitations, organisational culture, involving employees, communication, and teamwork make the integration procedures more complex. (Medfouni, 2024) found that organisations face challenges such as adopting end-to-end encryption and difficulties in implementing identity management functionalities, which require extensive system reconfiguration. SAP-ZATCA integration requires multidisciplinary engagement between finance, IT, and compliance units. Still, (Panchal & Khokrale, 2024) identified that alignment issues between business and IT units often result in project delays and lower system usage. (Rahman et al., 2024) discussed SAP implementation challenges, as it was revealed that high implementation costs, complex integration, and usability issues affect the successful adoption of the digital platforms. Moreover, (Almutairi, 2023) explored critical success factors in the integration of SAP digital platforms in Saudi Aramco, revealing that resistance from top management, departments that do not communicate sufficiently, and users who are not given adequate instructions are key issues. Similarly, ensuring data integrity and managing change effectively are critical challenges in the successful integration of SAP platforms (Ravi & Jampani, 2024).

Recent studies by (Medfouni, 2024; Nazarov et al., 2019; and Pałys, & Pałys, 2022) stated that SAP enhances tax compliance by automation and centralisation of the data, and minimising human error and inconsistencies. Similarly, (Yordanova, 2024) states that SAP and data analytics help to increase the accuracy and efficiency of VAT management and tax audit. These results are consistent with the overall views, stating that SAP offers significant benefits in simplifying processes involved in tax administration. However, (Bentley, 2020; and Djafri et al., 2023) posit that the adoption of automation leads to greater responsiveness of tax administrations, which, however, do not explore the bottlenecks of the operations of the rapidly changing tax systems, such as ZATCA in Saudi Arabia. The problem of regular regulatory changes in KSA, including modifications to VAT and Zakat regulations, also complicates the implementation of such systems since SAP must constantly be customised to keep up with these changes. The experience of SAP integration with digital tax platforms can be summarised as both supportive and critical, but not really questioning the genesis of such conflicting accounts. (Yordanova, 2024; and Medfouni, 2024) also accentuate that SAP has a positive effect on increasing tax compliance by automating, centralising information, and minimising mistakes. Nevertheless, (Escap, 2022; and Shekhar, 2023) warn about the issues of data interoperability and system compatibility that slow down the seamless integration. The differences in the level of technical infrastructure and maturity levels of the regulatory environment across regions cause these contradictions (Talha et al., 2025; Haris et al., 2025). The stable and developed economy in the OECD countries supports the seamless integration of SAP systems due to solid digital infrastructure and regulatory frameworks. On the contrary, the rapid rate of regulatory changes that have taken place in KSA, e.g., the frequent amendment of VAT, Zakat, and e-invoicing regulations, is a major implementation challenge. This is an indication that what has worked in advanced economies might not necessarily work in the Saudi environment, meaning that the regulatory environment is unstable and digital preparedness is yet to be completed in Saudi Arabia. Moreover, studies by (Bentley, 2020; and Djafri et al., 2023), in line with their findings reveal the effectiveness of SAP in automating audit tasks, the authors fail to acknowledge the challenges characteristic of the emerging economies under the scope of audit that possesses less stable tax regime, tax reforms, and rapidly developing systems like KSA.

The integration of digital platforms in fostering sustainable fiscal governance has been discussed within the existing empirical literature. According to (Sharma et al., 2025), a shift in the use of traditional manual systems to the advanced systems that are automated has restructured the financial processes, which has increased their level of accuracy, efficiency, and strategic capacities. While this may be true in theory, the staff fail to critically examine the operational challenges that organisations might encounter along the way through this transition, especially in an environment that lacks adequate technological infrastructure or an environment that lacks appropriate organisational preparation. Such technologies as AI and Machine Learning (ML), which are heralded for simplifying task management and enhancing data security, are often discussed in isolation, without addressing the practical challenges of their integration, particularly in less digitally mature environments. (Hocine et al., 2024) argued that the use of AI and ML in anomaly detection and transparency is presented as an obvious advantage. In contrast, the practical implementation of these technologies to the extent of stakeholder education and system optimisation demands considerable investment in this research area, which is rarely fully explored. Likewise, (Chukwuma-Eke et al., 2022) point out the prospects of SAP-based systems in helping to lower expenses and enhance real-time financial reporting, but they do not address the intricate nature of integrating those systems in industries that have varied regulatory landscapes, such as energy companies. Moreover, the study by (Nowicki et al., 2023) mentions that, SAP integration can enhance the accuracy of financial reporting by eliminating auditing process steps, but the efficiency improvement can take place only when the system is perfectly matched with other organisational processes, which many firms fail to achieve due to the shortage of multifunctional coordination and system legacy issues. These studies highlight the benefits of SAP and tend to minimise the multifaceted nature of the issues of getting such systems to work in real-life situations.

2.1. Theoretical Foundation

The Technology-Organisation-Environment (TOE) framework explains that adopting technological innovations is conditioned by the circumstances in compliance, Audit automation, and sustainable fiscal governance (Al Hadwer et al., 2021). TOE throws light on the complex interaction between technological endowments, organisational readiness, and regulatory environment that impact SAP-digital platform integration, which is part of Saudi Arabia’s taxation modernisation. The studies by (Medfouni, 2024; and Nazarov et al., 2019) mention the positive effect of SAP technological advantages, including automation and data centralisation, but not the issues in the organisational context that can block integration. (Almutairi, 2023) indicates that organisational preparedness, like good change management policies and employee engagement, is key to the success of SAP adoption, but this aspect is largely ignored in the literature. In the same manner, there is limited discussion on matters such as cross-unit coordination (Panchal & Khokrale, 2024; Sarwar et al., 2025), yet they are crucial in ensuring flawless integration. Additionally, the environment, especially the rapidly changing regulatory environment in KSA, is normally ranked as secondary as opposed to core aspects in the implementation process. According to (Yordanova, 2024), frequent VAT updates in KSA need to be adjusted regularly to the system, but in many cases, system adaptation is disregarded in favour of an improvement in the technological field. The applications of the theory indicate a methodological gap because the literature does not acknowledge this interconnectedness between the technological, organisational, and environmental factors. The TOE framework aligns that effective SAP integration needs a one-stop solution, which comprises technology, people, and policy to meet the challenges of digital tax changes, especially at the emerging economy level, with KSA being one such country as envisioned in its Vision 2030.

2.2. Empirical Gap

The present body of literature is considered critical due to a major empirical gap concerning the integration of SAP systems with those of digital taxation, with the situation of the Kingdom of Saudi Arabia (KSA). Even though the implementation of SAP and its benefits and issues have been examined in numerous countries, the majority of the studies have been performed in non-KSA-located regions, such as Algeria (Hocine et al., 2024), Egypt (Elsharnouby, 2024), OECD (Bentley, 2020; OECD, 2025), South Africa (Aroba & Abayomi, 2023), and Serbia (Radosavljević et al., 2023). These researchers mainly concentrate on developed and more technologically advanced economies or tax regimes in Africa, which have varying rates of technological framework, regulatory stability, and institutional readiness compared to the KSA. As an illustration, (Bentley, 2020; and Djafri et al., 2023) isolated the consequences of automation on tax administration in the OECD and North African jurisdictions, respectively, and (Sharma et al., 2025) debated the involvement of SAP-related governance enhancements in South Asian economies. Nonetheless, all these efforts lack empirical support on the impacts of SAP-digital platform integration in Saudi Arabia, especially under the prevailing dynamics and shifts brought by Vision 2030 and the current reforms on VAT and Zakat.

Moreover, the available literature tends to concentrate on the general ERP implementation by (Almutairi, 2023) or high-level digital transformation by (Nazarov et al., 2019) rather than discuss the particulars of integrating SAP and tax-specific digital systems, such as those run by KSA Zakat, Tax and Customs Authority (ZATCA). In addition, no previous empirical research measures the synergistic effect of SAP integration, e-invoicing, and tax reporting on compliance, automation of audits, and sustainable fiscal governance in Saudi Arabia. The reports by (Escap, 2022; OECD, 2024; and Shekhar, 2023) offer a regional/international outlook, but no data is found based on KSA SMEs or tax revenue originators. Since KSA has been characterised by changes in regulations, cultural peculiarities, and digital readiness gaps, the results based on foreign settings cannot be applied to the Saudi environment unless it is officially tested. As such, the study sheds light on an obvious empirical deficit as it presents first-hand data of 356 tax and accounting managers in the KSA SME sector, thus providing a region-specific data set on the technical, organisational, and regulatory patterns driving SAP and digital tax platform integration in the context of the Saudi taxation regime.

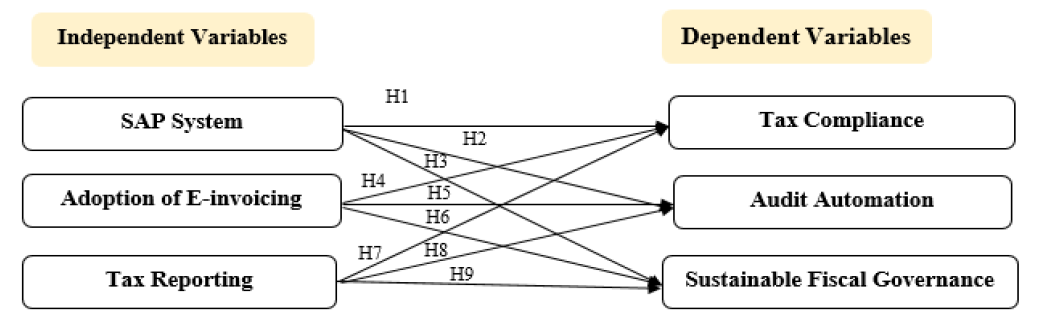

Based on the literature review, the following hypotheses have been devised:

H1: SAP system has a significant and positive impact on tax compliance in KSA.

H2: SAP system has a significant and positive impact on audit automation in KSA.

H3: SAP system has a significant and positive impact on sustainable fiscal governance in KSA.

H4: Adoption of E-invoicing has a significant and positive impact on tax compliance in KSA.

H5: Adoption of E-invoicing has a significant and positive impact on audit automation in KSA.

H6: Adoption of E-invoicing has a significant and positive impact on sustainable fiscal governance in KSA.

H7: Tax Reporting has a significant and positive impact on tax compliance in KSA.

H8: Tax Reporting has a significant and positive impact on audit automation in KSA.

H9: Tax Reporting has a significant and positive impact on sustainable fiscal governance in KSA.

Fig. (1) presents a conceptual framework outlining the integration of SAP systems with digital tax platforms for improving tax compliance, audit automation, and sustainable fiscal governance. The framework highlights independent variables, including SAP System, Adoption of E-invoicing, Tax Reporting, Continuous Control Monitoring, and Improving Tax Compliance. Organisational preparedness involves pre-preparedness of institutions through qualified personnel, effective change management as well as constant training to exploit these technologies. The regulatory environment is comprised of the dynamics of tax legislations, requirements of compliance and government policies that fuel the integration process.

Fig. (1). Conceptual framework.

3. METHODOLOGY

3.1. Sample and Data Collection

The study is based on a quantitative study method with the aim of making a systematic consideration of the issue of SAP integration, e-invoicing integration, audit automation integration, and tax reporting integration on tax compliance. The data is gathered among the accounting managers and the tax managers of various SMEs in KSA. The sample was selected to involve managers of accounting and taxes in different SME in KSA because they are directly engaged with the day-by-day operations of financial reporting, compliance, and taxation. Their working experience and opinions will guarantee that the data gathered is up to date and accurate, and that it reflects actual practices. Yet, purposive sampling tends to be characterised by selection bias (López, 2023). Nevertheless, this research has attempted to eliminate such bias by selecting participants of various backgrounds, with specific emphasis on accounting and tax managers of various SMEs within KSA to provide relevant and experience-based insights based on practical financial, compliance, and taxation practices. As found by the study of (Abobakr et al., 2024), the sampling of participants with a variety of backgrounds and platforms does not imply bias in sampling. The demographic profile of the respondents is provided in Table 1.

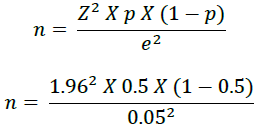

The targeted sample size of the study was calculated using the Cochrane formula as provided by (Nanjundeswaraswamy & Divakar, 2021), as shown below. The sample size as per this formula is obtained to be 384. Hence, the research targeted to reach a sample size of 384 accounting and tax managers.

n= 384

Where:

- n = sample size

- Zα/2 = Z value for the chosen confidence level (typically 1.96 for 95% confidence)

- p = estimated proportion (here assumed as 0.5 for maximum variability)

- E = margin of error (desired precision)

The survey was distributed to 600 respondents to achieve the targeted sample size. These participants were contacted through LinkedIn and personal contacts. However, only 387 responses were received, making the response rate 64.5%. These professionals were contacted using LinkedIn’s networking features, joining relevant industry groups, and messaging targeted individuals. Furthermore, colleagues, alumni, and personal connections shared the survey within their networks, which ensures broad research across different sectors and roles to maximise participation and attain the desired sample. In this way, the study used different platforms to ensure that there was no selection bias. After cleaning the data for missing values, 356 samples were retained, which were used for the final analysis. The sample number is selected to provide fair representation in different SMEs, enabling meaningful statistical analysis (Hair et al., 2017). Furthermore, it was also necessary to check for the non-response bias. (Chavez et al., 2023) indicated that non-respondents are more similar to the late respondents, and no statistically significant differences between early and late respondents imply that non-response bias is not a concern. Hence, following the method of (Dióssy et al., 2025; and Malik et al., 2024), the study conducted an independent sample t-test to compare statistically significant differences between early respondents (n1 = 30) and late respondents (n2 = 30). It was done to compare the first thirty respondents with the last thirty respondents. The results indicated that SAP system Integration (MD = -0.1, P-value = 0.670), adoption of E0-invoicing (MD = 0.28, P-value = 0.154), tax reporting (MD = 0.13, P-value = 0.626), tax compliance (MD = 0.33, P-value = 0.162), audit automation (MD = -0.06, P-value = 0.804), and sustainable fiscal governance (MD = -0.01, P-value = 0.964) have insignificant mean difference. None of the constructs revealed any statistically significant differences across n1 and n2, suggesting that the data collection technique does not suffer from non-response bias.

Table 1 presents demographic details of participants (N = 356). They were predominantly male (80.1%) and aged 26–35 years. The sampling comprised Account Managers (39%), Assistant Accountant (35.4%), and Tax Managers (25.6%). More than half had 3–6 years of experience (39.9%), reflecting professionally heterogeneous and moderately experienced respondent pool.

Table 1. Demographic characteristics.

| Category | n | % | |

| Gender | Male | 285 | 80.1 |

| Female | 71 | 19.9 | |

| Age | Up to 25 | 48 | 13.5 |

| 26–30 | 102 | 28.7 | |

| 31–35 | 93 | 26.1 | |

| 36–40 | 61 | 17.1 | |

| Above 40 | 52 | 14.6 | |

| Designation | Account Manager | 139 | 39 |

| Assistant Accountant | 126 | 35.4 | |

| Tax Manager | 91 | 25.6 | |

| Years of Experience | Up to 3 years | 88 | 24.7 |

| 3–6 years | 142 | 39.9 | |

| Above 6 years | 126 | 35.4 |

3.2. Measurement

SAP system integration: The questionnaire was adapted from the ERP implementation developed by (Bradley, 2008) which focuses on evaluating the effectiveness of ERP system like SAP within organisation. The scale involves key constructs such as system integration, process alignment and user satisfaction, that are important for successful integration. Three items were considered based on their relevance to the study which are present in Appendix A.

Adoption of E-invoicing: The scale was adapted from the technology acceptance model (TAM) by (Davis, 1989) and the Unified Theory of Acceptance and Use of Technology (UTAUT) by (Venkatesh et al., 2003). These models focus on constructs like perceived usefulness, perceived ease of use, and behavioural intention to use technology. These scales were adapted for E-invoicing. Three items were considered as attached in Appendix A.

Tax Reporting: The financial reporting quality scale was adapted from the developed one by (Barth et al., 2008) to measure accuracy, timeliness, as well as completeness of financial and tax information. The scales are useful when assessing compliance of the organisation with the reporting standards, and the objectives are to provide reliable information for compliance reporting and tax and fiscal governance. Three items had been takin into consideration as attached in Appendix A.

Tax Compliance: The survey was completed as an adjustment to the Tax Compliance Behaviour Scale alongside the (Kirchler et al., 2008) and OECD Tax Compliance Framework, which assesses the voluntary compliance and enforced tax compliance with regard to the attitudes of the tax duties. It assists in computing the behaviour and the motivation of the taxpayers, and it provides us with the facts about how successful systems and policies are in the enforcement of compliance in the organisations. They had taken into consideration three items, which are attached in Appendix A.

Audit Automation: The auditing technology usage scale using (Eulerich et al., 2023) tracks the usage of data in audits and automation of audits. It determines how organisations are using technology to enhance efficiency in auditing, detect anomalies and strengthen internal controls by use of automated audit trails and other tools. In appendix A, three items were deemed as attached.

Sustainable Fiscal Governance: Sustainable Fiscal Governance is an index that evaluates the degree of transparency, accountability, and reasonable length planning of fiscal governance and it is a subset of IMF Fiscal Transparency Code and OECD Fiscal Governance Framework. These scales gauge the ability of digital systems to enable responsible fiscal management of a sustainable pattern in the activities of governments and organisations, as it concerns the way they both manage their finances and make their decisions. Three items were considered as attached in Appendix A.

3.3. Data Analysis

This study employed Partial Least Squares Structural Equation Modelling (PLS-SEM) to assess the complex effects of system integration of SAP systems, e-invoicing adoption, and tax reporting on tax compliance, automation of auditing, and sustainable fiscal governance. PLS-SEM plays a vital role in explanatory and predictive research involving many latent variables. There are two stages of evaluation and these are measurement evaluation and structural model. The measurement model reflects construct validity, reliability, and the loadings of the indicators. The validity of the indicators is indicated by Factor loading values more than 0.6, and Cronbach’s alpha and composite reliability values more than 0.7 are believed to be reliable. The values of AVE greater than 0.5 are regarded as signs of convergent validity, and the HTMT ratio less than 0.85 can reliably indicate discriminant validity (Ringle et al., 2014). The structural model is composed of path coefficients and significance levels. The procedure allows concurrent evaluation of the precision of measurements and structural associations with a broad view of the outcome of the model on prediction.

4. RESULTS AND ANALYSIS

4.1. Measurement Model using Confirmatory Factor Analysis

The construct validity and reliability are demonstrated in Table 2. The value of the factor loadings has a limit of 0.6 to ensure whether the indicators are good measures of the construct and valid (Hair et al., 2017). The values of factor loading on all indicators were indicated to be greater than 0.6, indicating that there is satisfactory evidence of the indicators, and no variable ought to be eliminated. Moreover, Cronbach’s alpha and Composite reliability indicates that the constructs are reliable as the values were higher than the 0.7 measure. Thus, the tool employed is reported as valid. Furthermore, Average Variance Extracted (AVE) has values above the threshold of 0.5, which confirms the convergent validity.

Table 3 below shows the discriminant validity. It has been elaborated that the HTMT ratio has to be below 0.85 (Hair et al., 2017). The table above shows that the value of each variable is below 0.85, indicating that the data have not violated the assumption of discriminant validity.

4.2. Structural Model

Table 4 shows the structural model. The findings of the structural model indicate that e-invoicing adoption has a significant impact on audit automation (β = 0.17, p = 0.03) and sustainable fiscal governance (β = 0.23, p = 0.00), but has no impact on tax compliance (β= 0.08, p = 0.17). SAP system integration has a significant impact on tax compliance (β = 0.18, p = 0.01), but no impact on audit automation (β = -0.12, p = 0.12), or sustainable fiscal governance (β = -0.09, p = 0.23). Tax reporting has strong, statistically significant effects on each of the three outcomes, audit automation (β = 0.45, P = 0.00), sustainable fiscal governance (β = 0.40, P = 0.00), and tax compliance (β = 0.50, P = 0.00). Hence, it plays a significant role in facilitating proper tax and fiscal outcomes.

4.3. Model Explanatory Power

Table 5 shows the model’s explanatory power. Audit automation has an R-squared value of 0.218, or 21.8%. It shows that the independent variables explain 21.8% of the variation in audit automation. Sustainable fiscal governance has an R-squared value of 0.236, showing that the independent variables explain 23.6% of the variation in sustainable fiscal governance. Tax compliance has an R-squared value of 0.46, showing that the independent variables explain 46% of the variation in tax compliance.

Table 2. Construct validity and reliability.

| Latent Constructs | Indicators | Factor Loadings | Cronbach’s Alpha | Composite Reliability | AVE |

| Audit Automation | AA1 | 0.903 | 0.831 | 0.836 | 0.748 |

| AA2 | 0.930 | ||||

| AA3 | 0.889 | ||||

| Adoption of E-Invoicing | AE1 | 0.835 | 0.893 | 0.896 | 0.824 |

| AE2 | 0.911 | ||||

| AE3 | 0.846 | ||||

| Sustainable Fiscal Governance | SFG1 | 0.868 | 0.844 | 0.848 | 0.762 |

| SFG3 | 0.877 | ||||

| SFG2 | 0.917 | ||||

| SAP System Integration | SSI1 | 0.879 | 0.865 | 0.867 | 0.788 |

| SSI2 | 0.897 | ||||

| SSI3 | 0.843 | ||||

| Tax Compliance | TC1 | 0.909 | 0.904 | 0.904 | 0.839 |

| TC2 | 0.933 | ||||

| TC3 | 0.906 | ||||

| Tax Reporting | TR1 | 0.895 | 0.890 | 0.891 | 0.820 |

| TR2 | 0.930 | ||||

| TR3 | 0.892 |

Table 3. Discriminant validity.

| Variables | Adoption of E-Invoicing | Audit Automation | SAP System Integration | Sustainable Fiscal Governance | Tax Compliance |

| Audit Automation | 0.353 | ||||

| SAP System Integration | 0.599 | 0.268 | |||

| Sustainable Fiscal Governance | 0.429 | 0.732 | 0.318 | ||

| Tax Compliance | 0.463 | 0.468 | 0.613 | 0.516 | |

| Tax Reporting | 0.531 | 0.493 | 0.718 | 0.508 | 0.729 |

Table 4. Structural model.

| Variables | Path Coefficients | T-statistics | P-values |

| Adoption of E-Invoicing -> Audit Automation | 0.17** | 2.23 | 0.03 |

| Adoption of E-Invoicing -> Sustainable Fiscal Governance | 0.23*** | 3.37 | 0.00 |

| Adoption of E-Invoicing -> Tax Compliance | 0.08 | 1.38 | 0.17 |

| SAP System Integration -> Audit Automation | -0.12 | 1.54 | 0.12 |

| SAP System Integration -> Sustainable Fiscal Governance | -0.09 | 1.20 | 0.23 |

| SAP System Integration -> Tax Compliance | 0.18*** | 2.71 | 0.01 |

| Tax Reporting -> Audit Automation | 0.45*** | 6.26 | 0.00 |

| Tax Reporting -> Sustainable Fiscal Governance | 0.40*** | 5.58 | 0.00 |

| Tax Reporting -> Tax Compliance | 0.50*** | 8.33 | 0.00 |

Note: *** indicates significance at 1%, ** indicates significance at 5%, * indicates significance at 10%

Table 5. Model explanatory power.

| Variables | R-Square | R-Square Adjusted |

| Audit Automation | 0.218 | 0.212 |

| Sustainable Fiscal Governance | 0.236 | 0.230 |

| Tax Compliance | 0.460 | 0.455 |

4.4. Hypothesis Assessment Summary

Hypotheses test as shown in Table 6 indicates that among nine hypotheses, six were confirmed on the basis of p-values under the 0.05 threshold for significance. In particular, the SAP system has a significant effect on tax compliance (H1) but not on audit automation (H2) or sustainable fiscal governance (H3). Adopting e-invoicing has a significant positive effect in all three dimensions: tax compliance (H4), audit automation (H5), and sustainable fiscal governance (H6). Equally, tax reporting significantly affects all three areas (H7–H9) with extremely significant p-values. The results indicate the vital importance of digital solutions—namely, E-invoicing and tax reporting—in facilitating fiscal capacities in Saudi Arabia.

Table 6. Hypothesis assessment summary.

| S.No. | Hypothesis Number | P-values | Decision |

| H1 | SAP system has a significant and positive impact on tax compliance in KSA | 0.010 | Accepted |

| H2 | SAP system has a significant and positive impact on audit automation in KS | 0.120 | Rejected |

| H3 | SAP system has a significant and positive impact on sustainable fiscal governance in KSA | 0.230 | Rejected |

| H4 | Adoption of E-invoicing has a significant and positive impact on tax compliance in KSA | 0.010 | Accepted |

| H5 | Adoption of E-invoicing has a significant and positive impact on audit automation in KSA | 0.030 | Accepted |

| H6 | Adoption of E-invoicing has a significant and positive impact on sustainable fiscal governance in KSA | 0.000 | Accepted |

| H7 | Tax Reporting has a significant and positive impact on tax compliance in KSA | 0.000 | Accepted |

| H8 | Tax Reporting has a significant and positive impact on audit automation in KSA | 0.000 | Accepted |

| H9 | Tax Reporting has a significant and positive impact on sustainable fiscal governance in KSA | 0.000 | Accepted |

5. DISCUSSION

The study was conducted to investigate the integration of SAP systems with digital taxation platforms in KSA, focusing on how such integration enables regulatory compliance, automates audit procedures and supports sustainable fiscal governance. The findings from the analysis revealed that SAP system integration and tax reporting significantly impact tax compliance. However, e-invoicing does not have any significant impact on tax compliance. The findings are largely supported by the previous literature, such as (Medfouni, 2024) and (Yordanova, 2024), indicating that SAP system integration significantly impacts tax compliance, highlighting increased increased accuracy, audit efficiency and automation. (Nazarov et al., 2019) also confirmed that integration with digital tax platforms reduces errors and improves transparency. However, (Almutairi, 2023; and Rahman et al., 2024) indicated that complexities such as high costs, system interoperability and organisational resistance remain barriers. Hence, the e-invoicing has been indicated to have an insignificant influence in this context. The weaker association of e-invoicing with tax compliance in this research can be explained by cultural and institutional factors of the Middle East context. Saudi Arabia lags behind Western nations with mature digital infrastructures regarding digital transformation, which impacts adopting and properly using e-invoicing on a broad scale. Resistance to change at the cultural level, low digital literacy among SMEs, and institutional barriers like regulatory ambiguity or non-uniform enforcement can delay the effects of e-invoicing in KSA (Almutairi, 2023). The dependence on conventional accounting and the slower embracing of automated platforms in KSA lessen the potential benefits of e-invoicing and diminish its effect on tax compliance. As per the views of (Bentley, 2020; and (Djafri et al., 2023), the problem of continuous regulatory changes in KSA, including modifications to VAT and Zakat regulations, complicates SAP implementation to keep up with these changes. However, this needs further elaboration through qualitative or case study research to further elaborate on this aspect to have increase relevant of SAP integration into the audit automation and fiscal governance.

Moreover, according to the study findings, E-invoicing and tax reporting made significant differences in the audit automation and SAP system integration made no significant differences. The findings of the study that e-invoicing and tax reporting are significantly influencing the automation of audits are evidence-based by (Bentley, 2020), who confirms how real-time data capture, standardisation and digital traceability can enhance audit readiness and efficiency. According to (Radosavljević et al., 2023), e-invoicing facilitates the organised flow of information and immediate verification with more and more automation of audit trails and the decreasing number of manual checks. The studies carried out before were with the countries of Egypt, South Africa and Algeria, where it was observed that SAP integration tends to augment audit automation by having strong stakeholder interest and system synchronisation. Nevertheless, including fragmented system adoption and less cross-departmental coordination, KSA is still a problematic area, and it decreases the direct effect that SAP has on the effectiveness of audit automation. KSA has a cultural resistance to technological change and a preference for traditional practices, which weakens the adoption of SAP in KSA and its impact on audit automation. Institutional factors such as limited enforcement of digital mandates and inconsistent training in KSA further hinder effective integration, and SAP’s potential to increase audit accuracy, transparency, and efficiency in the local context is declining. The continuous regulatory changes of KSA related to taxation are also one of the reasons, as highlighted by the study of (Djafri et al., 2023).

Moreover, it was also found during the research that the implementation of E-invoicing and tax reporting also influences sustainable governance to a large extent. The integration of SAP has, however, been realised to have no effect. However, previous studies like (Sharma et al., 2025; and (Chukwuma-Eke et al., 2022) found that SAP integration is important for sustainable governance through improved transparency and data accuracy. However, in KSA, the limited impact can be observed from organisational resistance and incomplete system use, whereas standardised e-invoicing and tax reporting directly increase fiscal accountability. Institutional factors like regulatory gaps, inconsistency of digital enforcement, limited training, and lack of standardised system adoption have led to organisational resistance and incomplete SAP use. (Bentley, 2020) also indicated that continuous regulatory changes in KSA complicate SAP implementation. The Saudi context has the continuous mediation of VAT and Zakat regulations, which makes it complicated to keep up with these changes and, hence, develop an automated system. Internal changes are important for making the full use of SAP, particularly better interdepartmental collaboration, targeted training, and the use of middleware to integrate legacy systems (Elsharnouby, 2024; Panchal & Khokrale, 2024). As per the TOE framework, SAP’s technological capability is high (Nowicki et al., 2023; Sarwar et al., 2023), but organisational resistance (Almutairi, 2023) and regulatory gaps (Yordanova, 2024) hinder adoption.

The research findings have multiple policy implications for policymakers. Firstly, the strong influence of e-invoicing and tax reporting on automation in audits and sustainable governance means that increased investment in them can improve compliance, transparency, and fiscal management. Policymakers need to place a high priority on the roll-out of e-invoicing infrastructure and the enforcement of reporting requirements.

It also has important implications for organisations, such as harmonisation of internal processes with ZATCA’s digital mandates, which will not just enhance audit readiness but also lower operational risks. In contrast, the less significant effect of SAP integration underscores the necessity for closer cross-functional coordination, capacity development, and strategic planning. Organisations need to overcome internal resistance, replace legacy systems, and invest in employee training to maximise ERP features. Integration projects should also include finance, IT, and compliance teams from the beginning. The research highlights the need to link technological instruments with organisational preparedness and regulatory systems to realise sustainable tax governance in KSA.

CONCLUSION

This research examined the adoption of SAP systems, e-invoicing, and tax reporting into digital taxation platforms in KSA and their effects on tax compliance, audit automation, and sustainable fiscal governance. The research results show that the SAP system has a considerable and positive effect on tax compliance, mainly through increased automation and accuracy in reporting. Nevertheless, its effect on audit automation and sustainable governance is limited, mainly because of organisational resistance and disintegrated implementation processes. On the contrary, both tax reporting and e-invoicing exhibit significant positive impacts on sustainable fiscal governance and audit automation. Their potential for enabling real-time verification, guaranteeing traceability, and fostering fiscal accountability results in transparent and effective regulatory processes. These findings confirm the suggested research model and reinforce the necessity of specific measures addressing regional difficulties in digital transformation. Furthermore, the research encourages a more robust coupling of technological means and organisational preparedness to maximise the advantages of digital taxation reforms in KSA.

PRACTICAL IMPLICATION

The findings show that the study recommends that organisations in KSA develop tailor-made change management strategies to deal with SAP integration resistance, particularly in audit and governance processes. Training regimes must be implemented to enhance acquisition by users and technical ability. Policy makers should promote an overall digital adoption and align SAP and e-invoicing models of various industries. Additionally, real-time tracking and validating elements within tax platforms can advance adherence and regulate effectiveness. Collaborative initiatives between the government, technology service providers, and businesses can ensure a correlation between digital tools used and organisational readiness, effectively supporting a sustainable management of finances and an optimal digital taxation across the Saudi Kingdom.

The study reflects on the significant role of tax reporting and e-invoicing in enhancing the level of audit automation and sustainable fiscal management in KSA. The policy makers need to invest in digital tax infrastructure, namely, making compulsory e-invoicing and real-time tax reporting. However, these systems have weaknesses because the current development of the VAT and Zakat laws is not clear, making the implementation a challenge. In order to achieve this, regulatory changes must be more public, predictable, and have clear time schedules and guidelines. Moreover, it is essential to support such arrangements as digital literacy of SMEs, technical assistance, and standardised compliance practices. The achievement and difficulty in SAP integration also present a compulsive need for organisational preparedness policies, which include cross-functional co-ordination, staff training, and efficiency incentives to re-plant or replace the older systems. A comprehensive strategy that combines stable regulatory frameworks with organisational and technological readiness is necessary to guarantee sustainable tax compliance, efficient operation, and long-term fiscal transparency in Saudi Arabia.

THEORETICAL IMPLICATIONS

This research adds to the theorisation of digital taxation by refining the use of the TOE theory in the context of emerging economies. It showcases the significance of technological preparedness being inadequate in the absence of organisational fit and favourable regulatory settings. The varied effects of SAP systems, e-invoicing, and tax reporting on compliance, audit automation, and fiscal governance provide subtle understandings of the interactions between digital tools and institutional contexts. By exposing the limitations imposed by organisational resistance and regulatory uncertainty, the research highlights the requirement to improve current frameworks to more accurately explain socio-cultural and policy-driven factors in digital transformation.

LIMITATIONS AND FUTURE IMPLICATIONS

This study is contextually restricted to Saudi Arabia, whose special regulatory setting, level of digital maturity, and developing tax infrastructure can be quite different from those of other markets. Consequently, the findings’ generalisability to countries with more developed or differentiated tax regimes, European or North American countries, for instance, is limited. For greater global applicability, future research needs to make comparative studies between Gulf nations or other emerging markets with different degrees of digital uptake to examine contextual variations and the generalisability of findings. Future studies also need to make use of a mixed-methods approach with a combination of interviews among tax professionals, regulatory authorities, and IT experts to triangulate and enrich quantitative findings. A fuller roadmap is also justified for investigating the roles of new technologies in tax automation—especially artificial intelligence, blockchain, and real-time analytics. Their possibilities for boosting audit accuracy, transparency, and compliance efficiency can effectively broaden the theoretical and practical coverage of this research area.

AUTHOR’S CONTRIBUTION

M.A. has contributed to conceptualization, idea generation, problem statement, methodology, results analysis, results interpretation, writing – original draft.

CONSENT FOR PUBLICATION

Not applicable.

AVAILABILITY OF DATA AND MATERIALS

The data will be made available on reasonable request by contacting the corresponding author [M.A.].

FUNDING

None.

CONFLICT OF INTEREST

The authors declare that there is no conflict of interest regarding the publication of this article.

ACKNOWLEDGEMENTS

Declared none.

APPENDIX A: QUESTIONNAIRE

Section A: Demographic Profiles

- Gender

a) Male

b) Female - Age

a) Up to 25 years

b) 26-30 years

c) 31-35 years

d) 36-40 years

e) Above 40 years - Designation

a) Account Managers

b) Assistant Accountant

c) Tax Managers - Years of Experience

a) Up to 3 years

b) 3-6 years

c) Above 6 years

Section B: SAP System Integration

Rate the following based on the 5-point scale

1 = Strongly Disagree, 2 = Disagree, 3 = Neutral, 4 = Agree, 5 = Strongly Agree

| 1 | 2 | 3 | 4 | 5 | |

| The SAP system is well-integrated with other internal systems and processes. | |||||

| SAP implementation has aligned our business processes across departments. | |||||

| Users are satisfied with how SAP supports daily operations. |

Section C: Adoption of E-invoicing

Rate the following based on the 5-point scale

1 = Strongly Disagree, 2 = Disagree, 3 = Neutral, 4 = Agree, 5 = Strongly Agree

| 1 | 2 | 3 | 4 | 5 | |

| E-invoicing improves the efficiency and usefulness of financial operations. | |||||

| E-invoicing is easy to use in our routine financial procedures. | |||||

| Our employees intend to continue using E-invoicing in the future. |

Section D: Tax Reporting

Rate the following based on the scale described below

1 = Strongly Disagree, 2 = Disagree, 3 = Neutral, 4 = Agree, 5 = Strongly Agree

| 1 | 2 | 3 | 4 | 5 | |

| Tax data reported is accurate and reflects actual transactions. | |||||

| Tax reports are submitted in a timely manner. | |||||

| Our tax reporting system ensures completeness of financial data. |

Section E: Tax Compliance

Rate the following based on the points below described

1 = Strongly Disagree, 2 = Disagree, 3 = Neutral, 4 = Agree, 5 = Strongly Agree

| 1 | 2 | 3 | 4 | 5 | |

| Our organisation voluntarily complies with all applicable tax laws. | |||||

| Tax compliance is ensured through internal controls and audits. | |||||

| Employees have a positive attitude toward fulfilling tax obligations. |

Section F: Audit Automation

Rate the following statements based on following

1 = Strongly Disagree, 2 = Disagree, 3 = Neutral, 4 = Agree, 5 = Strongly Agree

| 1 | 2 | 3 | 4 | 5 | |

| We use data analytics tools to support the audit process. | |||||

| Automated systems help identify irregularities in financial data. | |||||

| Our audit functions are supported by digital technologies. |

Section G: Sustainable Fiscal Governance

Rate the following statement as per scales provided below

1 = Strongly Disagree, 2 = Disagree, 3 = Neutral, 4 = Agree, 5 = Strongly Agree

| 1 | 2 | 3 | 4 | 5 | |

| Our financial practices promote transparency and accountability. | |||||

| There is a long-term financial planning process in place. | |||||

| Digital systems are used to support responsible fiscal decision-making. |

REFERENCES

Abdul Rashid, S. F., & Ramli, R. (2024). Income Sustainability Through Tax Governance in the Digital Age. In Corporate Governance and Sustainability: Navigating Malaysia’s Business Landscape (pp. 157-172). Singapore: Springer Nature Singapore. https://doi.org/10.1007/978-981-97-7808-9_9.

Abobakr, M. A., Abdel-Kader, M., & F. Elbayoumi, A. F. (2024). An experimental investigation of the impact of sustainable ERP systems implementation on sustainability performance. Journal of Financial Reporting and Accounting. https://doi.org/10.1108/JFRA-04-2023-0207.

Al Hadwer, A., Tavana, M., Gillis, D., & Rezania, D. (2021). A systematic review of organizational factors impacting cloud-based technology adoption using technology-organization-environment framework. Internet of Things, 15, 100407. https://doi.org/10.1016/j.iot.2021.100407.

Al-Otaibi, M. I., Nor, N. M., Yusri, Y., & Guzaiz, N. (2024). The impact of new VAT enforcement on financial performance: Evidence from Saudi Arabia non-financial listed companies using the event study and ARMA model. Heliyon, 10(20). Available at: https://www.cell.com/heliyon/fulltext/S2405-8440(24)15168-7.

Almaqtari, F. A. (2024). The role of IT governance in the integration of ai in accounting and auditing operations. Economies, 12(8), 199. https://doi.org/10.3390/economies12080199.

Almohaimeed, M. (2021). Economic growth in oil-rich countries: a theoretical analysis with an application to Saudi Arabia. (Doctoral dissertation, University of York). Available at: https://etheses.whiterose.ac.uk/id/eprint/29155/.

Almutairi, E. S. M. H. (2023). Critical success factors in ERP implementation: A Case of Saudi ARAMCO. JournalNX, 9(6), 27-40. DOI: https://doi.org/10.17605/OSF.IO/RY2S4.

Altawyan, A. A. (2023). Challenges in applying saudi arabian tax treaties: digitalization, withholding tax, and permanent establishment of non-residents. Intertax, 51(8/9). https://doi.org/10.54648/taxi2023052.

Aroba, O. J., & Abayomi, A. (2023). An implementation of SAP enterprise resource planning–A case study of the South African revenue services and taxation sectors. Cogent Social Sciences, 9(1), 2228060. https://doi.org/10.1080/23311886.2023.2228060.

Barth, M. E., Landsman, W. R., & Lang, M. H. (2008). International accounting standards and accounting quality. Journal of Accounting Research, 46(3), 467-498. https://doi.org/10.1111/j.1475-679X.2008.00287.x.

Bentley, D. (2020). Digital tax administration: transforming the workforce to deliver. eJTR, 18, 353. Available at: https://heinonline.org/HOL/LandingPage?handle=hein.journals/ejotaxrs18 &div=19&id=&page=.

Bradley, J. (2008). Management based critical success factors in the implementation of Enterprise Resource Planning systems. International Journal of Accounting Information Systems, 9(3), 175-200. https://doi.org/10.1016/j.accinf.2008.04.001.

Chavez, R., Malik, M., Ghaderi, H., & Yu, W. (2023). Environmental collaboration with suppliers and cost performance: Exploring the contingency role of digital orientation from a circular economy perspective. International Journal of Operations & Production Management, 43(4), 651-675. https://doi.org/10.1108/IJOPM-01-2022-0072.

Chukwuma-Eke, E. C., Ogunsola, O. Y., & Isibor, N. J. (2022). Developing an integrated framework for SAP-based cost control and financial reporting in energy companies. International Journal of Multidisciplinary Research and Growth Evaluation, 3(1), 805-818. https://doi.org/10.54660/.IJMRGE.2022.3.1.805-818.

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 319-340. Available at: https://www.jstor.org/stable/249008.

Dióssy, K., Losonci, D., Aranyossy, M., & Demeter, K. (2025). The role of leadership in digital transformation–a paradox way to improve operational performance. Journal of Manufacturing Technology Management, 36(9), 88-113. https://doi.org/10.1108/JMTM-07-2024-0386.

Djafri, I. A., Damawati, I., Suharto, S., Satwika, I. G. A. R. P., & Rahmatullah, R. (2023). Utilization of information and communication technology in the tax administration system to increase taxpayer compliance. Ilomata International Journal of Tax and Accounting, 4(1), 14-25. https://doi.org/10.52728/ijtc.v4i1.670.

Elsharnouby, R., (2024). Exploring the challenges and CSFs of SAP implementations in the Egyptian public sector. Available at: https://lup.lub.lu.se/student-papers/search/publication/9164142.

Escap, U. (2022). The digitalization of tax administrations in Asia and the Pacific: a manual for practitioners. https://hdl.handle.net/20.500.12870/5291.

Eulerich, M., Masli, A., Pickerd, J., & Wood, D. A. (2023). The impact of audit technology on audit task outcomes: Evidence for technology‐based audit techniques. Contemporary Accounting Research, 40(2), 981-1012. https://doi.org/10.1111/1911-3846.12847.

Ghulaxe, V. (2024). SAP: Comprehensive Industrial Process Solutions for Businesses. Available at SSRN 5242216. https://dx.doi.org/10.2139/ssrn.5242216.

Gulzar, S., Sarwar, U., Sattar, S., Usman, M., & Quibtia, M. (2024). Tax Audit, Tax Penalty, Religiosity and Tax Compliance. Journal of Asian Development Studies, 13(3), 776-79. https://doi.org/10.62345/jads.2024.13.3.64.

Gupta, A. K., & Jain, U. (2024). Designing scalable architectures for SAP data warehousing with BW Bridge integration. International Journal of Research in Modern Engineering and Emerging Technology, 12(12), 150. Available at: https://www.researchgate.net/profile/Ankit-Gupta-109/publication/389274707_Designing_Scalable_Architectures_for_SAP_Data_Warehousing_with_BW_Bridge_Integration/links/67bc9591645ef274a493f0af/Designing-Scalable-Architectures-for-SAP-Data-Warehousing-with-BW-Bridge-Integration.pdf..

Hair, J., Hollingsworth, C. L., Randolph, A. B., & Chong, A. Y. L. (2017). An updated and expanded assessment of PLS-SEM in information systems research. Industrial Management & Data Systems, 117(3), 442-458. https://doi.org/10.1108/IMDS-04-2016-0130.

Haris, M., Ahmad, M. A., Hussain, S., Sarwar, U., Zafar, H., & Khan, M. B. (2025). Stimulating Online Purchase Intentions Through Digitalization: Intermediation of Perceptions and Electronic Word of Mouth in Fashion E-commerce. Journal of Asian Development Studies, 14(1), 1520-1538. https://doi.org/10.62345/jads.2025.14.1.120.

Hocine, Z., Chemmakh, M. A., & Tair, N. (2024). The impact of sap implementation on financial management effectiveness: a case study of occidental of Algeria LLC. Revue Etudes en Economie et Commerce et Finance, 12(1), 171-206. Available at: https://asjp.cerist.dz/index.php/en/article/238432.

Kirchler, E., Hoelzl, E., & Wahl, I. (2008). Enforced versus voluntary tax compliance: The “slippery slope” framework. Journal of Economic Psychology, 29(2), 210-225. https://doi.org/10.1016/j.joep.2007.05.004.

Kulkarni, A. (2024). Digital Transformation with SAP Hana. International Journal on Recent and Innovation Trends in Computing and Communication ISSN, 2321-8169. Available at: https://www.researchgate.net/profile/Amol-Kulkarni-23/publication/386540281_Digital_Transformation_with_SAP_Hana/links/675517d28eca147b25e3a665/Digital-Transformation-with-SAP-Hana.pdf.

López, M. (2023). The effect of sampling mode on response rate and bias in elite surveys. Quality & Quantity, 57(2), 1303-1319. https://doi.org/10.1007/s11135-022-01406-9.

Luz, H., Anjum, K. N., Joseph, S., & Olaoye, G. (2024). The role of SAP’s advanced analytics in enhancing decision-making processes. Available at: https://www.researchgate.net/profile/Hivez-Luz/publication/387222116_The_Role_of_SAP’s_Advanced_Analytics_in_Enhancing_Decision-Making_Processes/links/6764536fe74ca64e1f1e51ea/The-Role-of-SAPs-Advanced-Analytics-in-Enhancing-Decision-Making-Processes.pdf.

Malik, M., Andargoli, A., Clavijo, R. C., & Mikalef, P. (2024). A relational view of how social capital contributes to effective digital transformation outcomes. The Journal of Strategic Information Systems, 33(2), 101837. https://doi.org/10.1108/IJOPM-01-2022-0072.

Medfouni, H. (2024). Digital transformation in tax administration: evaluating the impact of sap implementation on revenue collection and tax evasion at the tax centre Oum El Bouaghi (Comparative study 2014-2023). Le Manager, 11(2), 254-290. Available at: https://asjp.cerist.dz/en/article/261510.

Nanjundeswaraswamy, T. S., & Divakar, S. (2021). Determination of sample size and sampling methods in applied research. Proceedings on Engineering Sciences, 3(1), 25-32. DOI: https://doi.org/10.24874/PES03.01.003.

Nazarov, M. A., Mikhaleva, O. L., & Chernousova, K. S. (2019). Digital transformation of tax administration. In International Scientific Conference “Digital Transformation of the Economy: Challenges, Trends, New Opportunities” (pp. 144-149). Cham: Springer International Publishing. https://doi.org/10.1007/978-3-030-27015-5_18.

Nowicki, T., Górko, M., & Jakubowski, P. (2023). System Integration in the SAP Environment in Finance Modules Using Artificial Intelligence: Challenges and Benefits. In International Conference on Intelligent Systems in Production Engineering and Maintenance (pp. 446-459). Cham: Springer Nature Switzerland. https://doi.org/10.1007/978-3-031-44282-7_35.

OECD, (2024). National E-invoicing FATOORA Program Retrieved June 26, 2025, from https://www.oecd.org/content/dam/oecd/en/topics/policy-issue-focus/inventory-of-tax-technology-initiatives/itti-case-study-description-saudi-arabia-e-invoicing.pdf.

OECD, (2025). Tax Administration Digitalisation and Digital Transformation Initiatives: Tax rule management and application. https://www.oecd.org/en/publications/tax-administration-digitalisation-and-digital-transformation-initiatives_c076d776-en/full-report/.

Olaopa, O. R., & Alsuhaibany, Y. M. (2023). Economic diversification in Saudi Arabia: the role of information communication technology and e-commerce in achieving Vision 2030 and beyond. International Journal of Technological Learning, Innovation and Development, 15(2), 137-161. https://doi.org/10.1504/IJTLID.2023.135347.

Pałys, A., & Pałys, M. (2022). The challenges for tax compliance in multinationals within the SAP environment. Procedia Computer Science, 207, 2384-2394. https://doi.org/10.1016/j.procs.2022.09.297.

Panchal, F., & Khokrale, S. (2024). Effective Project Management with SAP Project System (PS): Balancing Scope, Time and Budget Constraints. https://commons.clarku.edu/graduate_school_professional_studies/33.

Parimi, S. S. (2019). Automated Risk Assessment in SAP Financial Modules through Machine Learning. Available at SSRN 4934897. http://dx.doi.org/10.2139/ssrn.4934897.

Radosavljević, G., Babin, M., & Erić, M. (2023). The Pathway for the Effective Digital Transformation of the Tax Administration in Serbia. In International Symposium SymOrg (pp. 228-238). Cham: Springer International Publishing. https://doi.org/10.1007/978-3-031-18645-5_14.

Rahman, M. A., Bhowmik, J., Ahamed, M. S., & Rahman, R. (2024). Opportunities and challenges in data analysis using sap: A review of Erp software performance. International Journal of Management Information Systems and Data Science, Volume 01, Issue 04, 192. https://doi.org/10.62304/ijmisds.v1i04.192.

Ravi, V. K., & Jampani, S. (2024). Blockchain Integration in SAP for Supply Chain Transparency. Integrated Journal for Research in Arts and Humanities, 4(6), 10-55544. http://dx.doi.org/10.55544/ijrah.4.6.22.

Ringle, C., Da Silva, D., & Bido, D. (2014). Structural equation modeling with the SmartPLS. Brazilian Journal Of Marketing, 13(2). https://ssrn.com/abstract=2676422. (Retrieved from: October 19, 2015).

Sarwar, U., Ahmad, M. B., Mubeen, M., Fatima, I., & Rehan, M. (2023). A Bibliometric Analysis of Sustainability Disclosure in High Polluting Industries. Bulletin of Business and Economics (BBE), 12(3), 28-43. https://doi.org/10.5281/zenodo.8318525.

Sarwar, U., Baig, W., Rahi, S. & Sattar, S. (2025). Fostering green behavior in the workplace: The role of ethical climate, motivation states, and environmental knowledge. Sustainability, 17, 4083. https://doi.org/10.3390/su17094083.

Sarwar, U., Bint-e-Naeem, N., Fahmeed, L., & Atif, M. (2024). Role of perceived security and financial attitude in shaping behavioral intention under the moderation of financial literacy. Journal of Asian Development Studies, 13(3), 1380-1395. https://doi.org/10.62345/jads.2024.13.3.112.

Sharma, C., Sharma, R., & Sharma, K. (2025). The evolution of finance and controlling: SAP and intelligent systems. World Journal of Advanced Research and Reviews, 25(01), 1786-1795. https://doi.org/10.30574/wjarr.2025.25.1.0261.

Shaukat, M. Z., Yousaf, S. U., Sarwar, U., & Sattar, S. (2024). Thriving in turmoil: Unraveling the interplay of resources, resilience, and performance among SMEs in times of economic vulnerability. Bulletin of Business and Economics (BBE), 13(2), 164-173. https://doi.org/10.61506/01.00312.

SCTP, (2024). A Spotlight on Its Various Shapes And Form KEY TAKEAWAYS. (n.d.). Retrieved June 26, 2025, from https://www.sctp.org.sg/ArticlesResources/2024-Tax-TechnologyNM.pdf.

Shekhar, S. (2023). Framework for strategic implementation of sap-integrated distributed order management systems for enhanced supply chain coordination and efficiency. Tensorgate Journal of Sustainable Technology and Infrastructure for Developing Countries, 6(2), 23-40. Available at: https://www.researchgate.net/profile/Suman-Shekhar-9/publication/388028775_Framework_for_Strategic_Implementation_of_SAP Integrated_Distributed_Order_Management_Systems_for_Enhanced_Supply_Chain_Coordination_and_Efficiency/links/6787ca271afb4e11f5e7ee1b/Framework-for-Strategic-Implementation-of-SAP-Integrated-Distributed-Order-Management-Systems-for-Enhanced-Supply-Chain-Coordination-and-Efficiency.pdf.

Talha, M., Saleem, S., Shahbaz, K., Sarwar, U., & Sattar, S. (2025). Investigating financial knowledge driven entrepreneurial intentions: the intermediation of financial knowledge and contingency of risk-taking propensity. Center for Management Science Research, 3(3), 450-469. https://cmsr.info/index.php/Journal/article/view/152.

Venkatesh, V., Morris, M. G., Davis, G. B., & Davis, F. D. (2003). User acceptance of information technology: Toward a unified view. MIS Quarterly, 425-478. Available at: https://www.jstor.org/stable/30036540.

Yordanova, Z. (2024). Supporting digitalization of ERP (SAP) value-added tax management through data analytics tools. In Olympus International Conference on Supply Chains (pp. 215-227). Cham: Springer Nature Switzerland. https://doi.org/10.1007/978-3-031-69344-1_16.