PDF

PDF

1College of Business Administration, Imam Abdulrehman Bin Faisal University, Dammam, Saudia Arabia

Received: 10 July, 2025

Accepted: 11 September, 2025

Revised: 06 August, 2025

Published: 02 October, 2025

Abstract:

Aim: The study was conducted to evaluate the impact of SDG-related investment on the financial performance of FTSE 100 firms. The study also investigated the moderating impact of ownership structure.

Method: For this purpose, the study utilised data from 70 firms of the FTSE 100 index selected based on different market capitalisation groups from 2015 to 2024 to capture this dynamic over a more extended period. The analysis was conducted using GLS regression due to heteroscedasticity and autocorrelation.

Findings: The findings indicated that SDG (B = -0.495, p-value = 0.000) negatively and significantly impacts the ROA. SDG (B = 2.695, p-value = 0.001) positively and significantly impacts the ROE. Executive ownership (B = 1.692, p-value = 0.006) significantly and positively moderates the relationship between SDG and ROA. Institutional ownership (B = 0.133, p-value = 0.565) has an insignificant and positive moderating role on the relationship between SDG and ROA. Ownership concentration (B = 2.560, p-value = 0.012) positively and significantly moderates the relationship between SDG and ROA. Executive ownership (B = 1.873, p-value = 0.505) has an insignificant and positive moderating role on the relationship between SDG and ROE. Institutional Ownership (B = -0.776, p-value = 0.274) has an insignificant and negative moderating role in the SDG and ROE relationship. Ownership concentration (B = -16.199, p-value = 0.001) positively and significantly moderates the relationship between SDG and ROE.

Implications: The findings highlighted the unique governance and market dynamics in developed economies, suggesting that ownership can affect performance directly but not through SDG investments.

Keywords: SDG-related investment, financial performance, ownership structure, ownership concentration, institutional ownership, ROA, ROE.

1. INTRODUCTION

The United Nations’ Sustainable Development Goals (SDGs) of 2015 have emerged as an essential global corporate strategy framework. The companies increasingly use SDGs to align investments to contribute to environmental stewardship, social Equity, and economic growth (Halisçelik & Soytas, 2019; Montiel et al., 2021). This trend comes as a larger understanding that sustainable business drives long-term value, brand reputation, and risk mitigation concerning regulatory shifts and stakeholder demands (Zioło et al., 2023) However, the financial implications of making such SDG-related investments have continued to be debated. While some research, such as Saha et al. (2024) and Shen et al. (2024), finds positive relationships between sustainability initiatives and financial performance by firms, other research, such as Naibaho & Shahab (2025), finds costs and risks that might suppress short-term profitability. This study empirically investigates the role of SDG investment on the financial performance of the FTSE-100 companies and the moderating role of ownership structure.

FTSE-100 companies, as major multinational enterprises, have unique problems in this regard. Under extreme regulatory examination and high investor expectations, these companies must reconcile substantial financial rewards with heavy sustainability commitments. The interplay of implementing various SDGs into business operations, combined with global supply chain threats and changing stakeholder pressures, is a key management challenge (Necib & Jarboui, 2025). In addition, the absence of agreed-upon metrics to measure the financial effects of SDG investments makes decision-making more difficult (Ceesay et al., 2021). An insight into how FTSE-100 companies manage these dynamics is important for formulating effective strategies that maximize sustainability and profitability.

While there has been growing emphasis on sustainability, little research has addressed how ownership structure moderates the link between SDG-related investment and firm financial performance, especially in large multinationals. Even most existing studies, like Saha et al. (2024) and Shen et al. (2024), look at the direct impacts of SDG activities while ignoring the governance mechanisms, such as ownership concentration and executive or institutional ownership. Previous work, (Naibaho & Shahab, 2025 and Al Lawati, 2022), concentrates on emerging economies or small companies, not capturing the complexities of the regulatory and stakeholder contexts of FTSE-100 companies. This work bridges this literature gap by exploring Ownership as a moderator within sustainability–performance relationships.

It is significant to conduct this study because it responds to an essential gap in the current literature by empirically exploring how different forms of Ownership, concentrated, executive, and institutional, moderate the relationship between SDG investments and a firm’s financial performance. Firms are investing more in sustainability, but the financial performance of such investment is unknown, particularly in high-profile firms such as those in the FTSE-100. By investigating the moderating effect of ownership, the research contributes insightful knowledge into how different governance mechanisms create strategic sustainability outcomes. The findings can inform policymakers, investors, and business leaders on how to maximise governance models for maximising both sustainability effects and profit.

This study contributes to the existing sustainability-performance literature in three ways. It empirically analyses the moderating effect of ownership structures on the interaction relationship between investments in SDGs and firm financial performance, particularly in terms of ownership concentration, executive Ownership, and institutional Ownership. Besides, the current study’s findings shall shed light on how different governance mechanisms shape the strategic and financial implications of sustainability investments in multinationals. Third, the results provide actionable implications for policymakers, investors, and corporate executives seeking to align governance arrangements with long-term sustainable value creation. Hence, this study contributes to scholarly and policy discussions of how best to design ownership and governance arrangements to facilitate sustainable development in the private sector.

The paper is organized as follows: Section 2 reviews the related literature and theories supporting the findings. Section 3 provides a methodological overview of the techniques and approaches used to conduct this research. Section 4 discusses the results and presents the study’s findings. Section 5 discusses findings, and Section 6 concludes with implications and future research.

2. LITERATURE REVIEW

2.1. Theoretical Framework

The research question about the relationship between SDGs and financial performance can be better understood with the help of stakeholder theory, indicating that companies are successful since they fulfil the interests of all stakeholders and not only the shareholders. Stakeholder theory suggests that a company’s success is contingent upon fulfilling the expectations of various stakeholders, such as workers, consumers, investors, communities, and the natural world. For the research, stakeholder theory offers a valuable framework for exploring how SDG investments affect the financial performance of firms. By incorporating SDG projects into corporate strategy, companies signal responsiveness to stakeholder issues concerning social Equity, environmental sustainability, and ethical governance, which are increasingly focused on by investors, regulators, and consumers alike (Habib et al., 2025).

The theory maintains that companies practicing sustainability establish trust, legitimacy, and long-term stakeholder relations, which can translate to improved reputation, employee commitment, operational effectiveness, and financial outcomes. In contrast to agency theory, which aims to reconcile managerial and shareholder interests, stakeholder theory focuses on all the groups affected by the firm’s operations. The approach applies to FTSE-100 firms operating within intricate, global markets with diverse, ever-changing stakeholder expectations (Saha et al. 2024). Thus, the stakeholder theory supports the view that investments related to SDG projects are ethical imperatives and strategic acts that can bring competitive advantage and sustainable profitability through value co-creation.

The agency theory helps in understanding the moderating role of ownership structure. Agency theory identifies how ownership structure affects managerial action and firm performance by resolving conflicts between agents and principals. Ownership concentration, executive Ownership, and institutional Ownership all enhance alignment of managers with shareholders through increased monitoring and lower agency costs. Such types of Ownership encourage adherence to long-term plans, e.g., SDG investments, by ensuring that managers focus on sustainable value creation rather than short-term benefits (Alshareef, 2024; Casciello et al., 2025; Shafai & Abd-Mutalib, 2024). Thus, they can moderate the interaction between SDG investments and firm performance by instilling disciplined monitoring, mitigating managerial opportunism, and facilitating effective resource allocation towards sustainable development objectives (Jibril, 2024; Truong, 2025; Yang et al., 2024).

In the framework of this research, agency theory is especially applicable to describing how various modes of Ownership, including ownership concentration, executive Ownership, and institutional Ownership, can be used as governance tools to control agency conflicts. Ownership concentration usually increases shareholders’ monitoring capacity relative to management, thus decreasing the probability of opportunistic activity and inducing more constrained, value-driven decision-making (Truong, 2025). Executive Ownership, in which managers have significant equity holdings, aligns manager and shareholder interests by internalizing the costs and benefits of choice (Wardan & Rizki, 2024). Likewise, institutional investors, due to their resources and expertise, tend to take an active role in corporate governance, enhancing transparency and accountability (Wu et al., 2022; Attarit et al., 2025). These ownership structures become particularly crucial when companies make long-term, strategic investments like those related to the SDGs. Since SDG-targeted investments tend to have high upfront costs and ambiguous future benefits, agency theory predicts that managers will favour short-term gains over long-term sustainability efforts in the absence of robust governance. Ownership structures that minimize agency costs can thus support managerial allegiance towards SDG investments by facilitating longer planning horizons and efficient resource allocation.

However, the current literature does not provide empirical evidence on the moderating role of ownership structure on the relationship between SDG investment and firm performance. Furthermore, the research on SDG investment is increasing, and there is not much empirical evidence conducted in this regard, with the most recent study of Javed et al. (2024), which has specifically investigated the impact of SDG investment on financial performance. To the best of the researcher’s knowledge, much is not yet developed around these dynamics in the current literature. Hence, this study contributes to the current knowledge by providing empirical evidence on the moderating role of ownership structure on the relationship between SDG investment and firm performance.

2.2. SDG Investment and Financial Performance

The correlation between investment for SDGs and financial performance can be understood with the aid of stakeholder theory, which says that companies are successful because they fulfil the interests of all stakeholders and not shareholders alone. Investment in SDGs builds trust, reputation, and long-term stakeholder relationships, contributing to customer loyalty, employee commitment, and access to capital (Habib et al., 2025; Qaderi, 2025; Schena et al., 2025). These contribute towards greater operational efficiency and lower risk, ultimately leading to better financial performance. By adopting society’s objectives, companies generate shared value, wherein environmental and social value is converted into sustained profitability (Lin et al., 2025; Haris et al., 2025; and Sarwar et al., 2024). Therefore, when carefully managed, SDG-related investments can generate social impact alongside financial return.

The study of Shen et al. (2024) investigated the impact of SDGs on financial performance. The study used the period from 2010 to 2020 from a dataset of 2744 Chinese firms. The study found that SDG-related financial performance activities are positive and significant. The study of Saha et al. (2024) investigated the impact of SDG practices on financial performance. It has considered the top-listed companies in finance, manufacturing, and technology industries of 100 organisations from 17 countries in developed, developing, and emerging economies. The study found the positive impact of SDG-related investment on financial performance.

Furthermore, Lin et al. (2025) conducted a study to evaluate the impact of SDG on financial performance, considering the sample of 380 companies from different countries in the automobile industry. It has been found that SDGs significantly and positively impact the financial performance of the companies. These findings were also supported by the studies, such as Al Lawati (2022) conducted in Oman, Berreta et al. (2024) conducted in Italy, and (Kayed & Meqbel, 2025) conducted in Europe, which revealed a positive impact of SDG on the financial performance. However, the study of (Naibaho & Shahab, 2025) evaluated this relationship using the 100 firms listed in the Fortune 500 in the industrials, materials, and energy sectors from 2019 to 2023. The study findings indicated the negative effect of SDGs on the companies’ financial performance, indicating that SDG-related risks reduce their performance. There has been a mixed consensus among previous research, where the studies have either obtained positive or negative effects. Based on these empirical studies, the following hypothesis is developed:

H1: SDG-related investment has a significant and positive impact on the financial performance

2.3. Moderating Role of Ownership Structure

Executive Ownership describes the degree to which executives of a firm own shares in the company (Yue et al., 2025). Executive Ownership, based on agency theory, serves to align managerial (agent) interests with those of shareholders (principals), minimising agency conflicts and encouraging long-term firm value-enhancing decisions (Wardan & Rizki, 2024). In the context of SDG-related investment, executive Ownership can exert a pivotal moderating influence on the effects of such investments on firm performance.

When top managers hold significant ownership stakes, they are more likely to focus on long-term, value-creating activities, like investments that align with the SDG, since their personal fortunes directly correlate with the long-term performance of the company (Gulzar et al., 2024; and Talha et al., 2025). Such Ownership motivates them to make thoughtful decisions about SDG initiatives that maximise social and financial returns (Lassala et al., 2021; Sarwar et al., 2023). In addition, owner-executives are less inclined to pursue short-termism, making them more likely to pursue SDG investments that are costly in the short term but profitable in the long term. In contrast, in low-executive-ownership firms, managers do not have incentives to pursue or manage SDG investments effectively, as they perceive them as a drag or a side activity (Jan et al., 2021). Executive Ownership thus reinforces the positive association between SDG investments and financial performance by promoting strategic fit, responsibility, and long-term value creation. Based on the literature, it can be hypothesised that;

H2: Executive Ownership has a significant moderating effect on the relationship between SDG-related investment and financial performance

Ownership concentration refers to the Degree to which major, influential shareholders own a company’s shares (Chen et al., 2021). Under agency theory, high ownership concentration minimizes agency problems by allowing large shareholders to have more control over management decisions, thus aligning managerial actions with shareholder interests. In the case of SDG-related investments, ownership concentration is an important moderating factor in influencing their effects on firm performance (Meqbel et al., 2025).

Concentrated ownership firms are more capable of enforcing and tracking SDG investments. Large owners have a long-term time horizon and enough power to make sustainability efforts that are not symbolic but strategically embedded in business practice. They have enough clout to ensure that they induce sustainable practices that build the company’s reputation, minimise risk exposure, and maximize operating efficiency, thus leading to improved financial performance (Saeed et al., 2025).

Additionally, concentrated owners can more likely call for transparency and quantifiable returns from SDG investments, decreasing the likelihood of managerial opportunism or misallocation of resources. On the other hand, dispersedly owned firms can be challenged by coordination and monitoring, constraining the strategic value of SDG initiatives (Wardan & Rizki, 2024). Thus, ownership concentration reinforces the positive effect of SDG-related investments on firm performance through improving governance, accountability, and long-term strategic concentration. Hence, it can be hypothesised that;

H3: Ownership Concentration has a significant moderating effect on the relationship between SDG-related investment and financial performance

Institutional Ownership is the shareholding of firms like pension funds, insurance companies, mutual funds, and other financial institutions. Such investors generally have significant resources, professional skills, and long-term investment horizons, thus significantly influencing corporate governance (Velte, 2023). In agency theory, institutional owners act as powerful watchdogs on management, minimising agency conflicts and fostering accountability (Wu et al., 2022).

Within SDG-linked investments, institutional Ownership has the potential to moderate between sustainability initiatives and company performance strongly (Sarwar et al., 2025; Shaukat et al., 2024). Institutional investors increasingly encourage environmental, social, and governance (ESG) integration, observing that SDG-linked strategies can lower risk, catalyse innovation, and improve long-term financial performance. Their active involvement, through voting rights, shareholder proposals, and communications with management, helps to ensure that SDG investments are value-creating in nature and not mere gestures (Yahaya, 2025).

Additionally, institutional owners require more transparency, uniform reporting, and measurable effects, making the SDG initiatives more effective. They also exert reputational pressure on companies to take sustainability seriously. For companies with high institutional Ownership, SDG investment is more likely to be well-prepared, properly executed, and well-accepted by the market (Bashiru et al., 2022). Institutional Ownership consolidates the positive relationship between SDG investment and firm performance through intensified monitoring, credibility, and strategic orientation (Wardan & Rizki, 2024). Hence, it can be hypothesised that;

H4: Institutional Ownership has a significant moderating effect on the relationship between SDG-related investment and financial performance

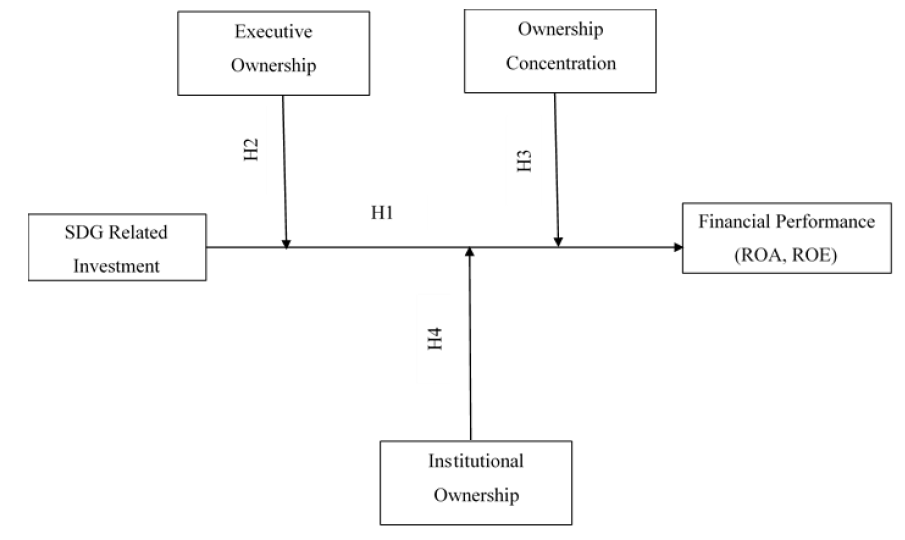

2.4. Conceptual Framework

Fig. (1) shows the conceptual framework of the study. The theoretical framework of this research examines the connection between SDG-related investment and firm financial performance, moderated by ownership structure. Based on stakeholder and agency theories, the framework suggests that SDG-targeted investments can improve a firm’s financial performance through enhanced stakeholder relations, operational performance, and long-term value creation (Jiang et al., 2023). Nevertheless, the direction and magnitude of this relationship can differ under different ownership structures for firms. Three aspects of ownership structure, executive Ownership, concentration of Ownership, and institutional Ownership, are suggested to serve as moderators. Executive Ownership realigns managerial interests with shareholder interests, promoting strategic commitment towards SDGs. Concentration of Ownership allows controlling shareholders to influence sustainability decisions to ensure accountability and efficacy. Institutional Ownership introduces professional monitoring, requiring transparency and incorporation of ESG disciplines (Wu et al., 2022).

Fig. (1). Conceptual framework.

3. METHODOLOGY

3.1. Sampling and Data Collection

The study was conducted using a quantitative approach to estimate the cause-and-effect relationship. Previous studies, such as those by (Javed et al., 2024; and Kayed & Meqbel, 2025), that evaluated the relationship between SDG and firm performance have also adopted the method. The sample used in this study is drawn from the FTSE 100 index, which comprises the largest listed firms on the London Stock Exchange. To ensure diversity and representation of different firm sizes, the firms were classified into five groups using market capitalisation. The classification thresholds were as follows: Group 1 (Very Large-Cap) consists of companies with market capitalisation over £80 billion; Group 2 (Large-Cap) consists of those with market capitalisation between £60 billion and £80 billion; Group 3 (Upper Mid-Cap) consists of companies with market capitalisation between £40 billion and £60 billion; Group 4 (Lower Mid-Cap) consists of companies with market capitalisation between £20 billion and £40 billion; and Group 5 (Small-Cap within FTSE 100) consists of companies with market capitalisation less than £20 billion. 70% of the firms from each grouping were then selected using stratified random sampling, yielding 14 firms per grouping and an overall sample size of 70 firms. This sampling method provides proportional representation and facilitates valid comparisons between firms of different sizes (Bougie & Sekaran, 2019). Data collection took place over ten years, between 2015 and 2024, corresponding with the post-adoption period of the United Nations SDGs. This period allows enough time to analyse the long-term impact of SDG investment on the performance of firms. Data for SDG investments and ownership structure were obtained from the annual reports of the chosen firms, providing qualitative and quantitative data. Performance metrics for financials, including return on assets, return on Equity, firm size, and leverage, were obtained from the Refinitiv Eikon to maintain consistency and accuracy in analysis.3.2. Variable Measurement

Table 1 describes the variables’ measurement. SDG-investment is quantified by tabulating the number of SDGs a company has reported in its annual report, adopting the method of (Al Lawati, 2022). This is an indicator of a firm’s scope of commitment to sustainability. Firm performance is measured based on two commonly used financial ratios: Return on Assets (ROA) and Return on Equity (ROE). ROA is measured as net profit divided by total assets, whereas ROE is determined as net profit divided by total Equity. These indicators were adopted from (Veeravel et al., 2024) and reflect profitability concerning the firm’s resource base and Equity. Both indicators’ data were obtained from the Reuters database.Table 1. Variable measurement.

| Variables | Measurement | References | Source |

| SDG Disclosure | The number of SDG goals that the company has followed. | (Al Lawati, 2022) | Annual Report |

| Firm Performance | Return on Assets (ROA) = Net Profit/Total Assets | (Veeravel et al., 2024) | Refinitiv Eikon |

| Return on Equity (ROE) = Net Profit/Total Equity | |||

| Executive Ownership | Percentage of shares held by executive directors of the company | (Boshnak, 2024) | Annual Report |

| Ownership Concentration | Percentage of shares held by blockholders | (Truong, 2025) | |

| Institutional Ownership | Percentage of shares held by financial institutions such as banks | (Saleh et al., 2024) | |

| Firm Size | Natural Logarithm of Total Assets | (Truong, 2025) | Refinitiv Eikon |

| Leverage | Debt/Equity | (Veeravel et al., 2024) |

3.3. Data Analysis

The analysis utilised panel data regression to test the association between SDGs and company financial performance over 10 years. The fixed effect and random effect models were first estimated to control for heterogeneity not observed among firms. The Hausman test was subsequently implemented to identify the more suitable model between the two. After model choice, tests for heteroskedasticity and autocorrelation were conducted to verify the strength of the regression estimates. In accordance with the occurrence of these problems, the Generalised Least Squares (GLS) model was employed, providing more efficient and robust estimates under non-constant variance and autocorrelated errors.4. RESULTS AND DISCUSSION

4.1. Descriptive Statistics

Table 2 shows the descriptive statistics of the variables. It shows that ROA has a mean value of 9.780% with a standard deviation of 24.827%, indicating high volatility in the profitability of FTSE 100 firms. Furthermore, ROE has a mean of 28.157% with a standard deviation of 133.066%, showing higher variability in profitability. SDG has a mean value of 1.529 with a standard deviation of 2.890. It shows that FTSE 100 firms, on average, consider 1 or 2 SDGs, while it has higher variability, with some firms adopting all 17 SDGs. Executive Ownership has a mean value of 0.079 or 7.9% with a standard deviation of 3%, showing a lower proportion of shares held by executive directors. Institutional Ownership, with a mean value of 0.322 (32.2%) and a standard deviation of 0.124 (12.4%), shows a higher proportion of institutional investors in these firms. Ownership concentration, with a mean of 0.15 (15%) and a standard deviation of 0.02 (2%), shows a considerable proportion of concentrated owners. Firm size, with a mean value of 9.651 and a standard deviation of 2.009, shows the diversity of the firms being considered in the sample regarding their size. Debt to Equity has a mean value of 10.905% with a standard deviation of 37.194%, which shows the optimal amount of debt the firm considers.Table 2. Descriptive statistics.

| Variables | Obs | Mean | Std. Dev. | Min | Max |

| ROA (%) | 700 | 9.780 | 24.827 | -68.670 | 236.780 |

| ROE (%) | 700 | 28.157 | 133.066 | -328.470 | 2409.860 |

| SDG | 700 | 1.529 | 2.890 | 0.000 | 17.000 |

| Executive Ownership (%) | 700 | 0.079 | 0.030 | 0.005 | 0.168 |

| Institutional Ownership (%) | 700 | 0.322 | 0.124 | 0.001 | 0.801 |

| Ownership Concentration (%) | 700 | 0.150 | 0.020 | 0.094 | 0.215 |

| Firm Size | 700 | 9.651 | 2.009 | 4.211 | 14.927 |

| Debt to Equity | 700 | 10.905 | 37.194 | 8.129 | 288.669 |

4.2. Correlation Analysis

Table 3 shows the correlation analysis of the study. It shows that ROA has a weak, positive, and insignificant relationship with SDG, institutional ownership, and ownership concentration. On the other hand, it has a weak, negative, and insignificant relationship with executive Ownership and debt to Equity. ROA and firm size have a negative, moderate, and significant relationship. ROE has also been indicated as a positive, weak, and insignificant relationship with SDG, institutional ownership, and ownership concentration.Table 3. Correlation analysis.

| ROA | ROE | SDG | Executive Ownership | Institutional Ownership | Ownership Concentration | Firm Size | Debt to Equity | |

| ROA | 1 | |||||||

| ROE | 0.794** | 1 | ||||||

| SDG | 0.050 | 0.005 | 1 | |||||

| Executive Ownership | -0.036 | -0.030 | -0.014 | 1 | ||||

| Institutional Ownership | 0.003 | 0.024 | -0.026 | 0.003 | 1 | |||

| Ownership Concentration | 0.019 | 0.054 | 0.011 | 0.047 | 0.039 | 1 | ||

| Firm Size | -0.412** | -0.259** | -0.055 | -0.057 | 0.009 | -0.009 | 1 | |

| Debt to Equity | -0.017 | -0.013 | -0.070 | -0.041 | 0.015 | 0.018 | 0.450** | 1 |

4.3. Panel Data Regression

Table 4 shows the regression analysis for ROA as the dependent variable. The Hausman specification test shows the choice of the random effect model. However, the issues of heteroscedasticity and autocorrelation are present in the model, which justifies the use of the GLS model for providing robust standard errors. Since the endogeneity issue has not been found in the models shown in Table 4, using GLS regression here instead of GMM is justified. GMM is suitable when there are endogenous variables in the model, and since the robustness test shows no such issue, GLS is most suitable in this case. It shows that SDG (B = -0.495, p-value = 0.000) negatively and significantly impacts the ROA.Table 4. GLS regression.

| Model 1: ROA | Model 2: ROE | |||

| ROA | Coefficient | P-value | Coefficient | P-value |

| SDG | -0.495*** | 0.000 | 2.695*** | 0.001 |

| EO | 0.144 | 0.831 | -8.043 | 0.269 |

| IO | 0.282* | 0.088 | 4.754*** | 0.007 |

| OC | 3.538*** | 0.001 | 79.840*** | 0.000 |

| DE | -0.018 | 0.204 | -0.210 | 0.224 |

| FS | -0.002*** | 0.000 | 0.006 | 0.667 |

| EO*SDG | 1.692*** | 0.006 | 1.873 | 0.505 |

| IO*SDG | 0.133 | 0.565 | -0.776 | 0.274 |

| OC*SDG | 2.560** | 0.012 | -16.199*** | 0.001 |

| R-Square | 0.2214 | 0.1016 | ||

| F-Statistics | 30.68*** | 31.13*** | ||

| Hausman | 10.02 | 49.40*** | ||

| Heteroscedasticity | 1566484.53*** | 6142958.71*** | ||

| Autocorrelation | 5.831** | 14.318*** | ||

| Endogeneity | 2.099 | 2.119 | ||

Table 5. GLS regression according to sample groups.

| Model 1: ROA | Model 2: ROE | |||

| Coefficient | P-value | Coefficient | P-value | |

| SDG | -0.631*** | 0.000 | 1.099 | 0.108 |

| EO | -0.235 | 0.240 | -6.483 | 0.247 |

| IO | -0.021 | 0.731 | 1.758 | 0.201 |

| OC | 0.251 | 0.560 | 66.656*** | 0.000 |

| DE | 0.029*** | 0.002 | -0.112 | 0.561 |

| FS | 0.000*** | 0.007 | 0.020* | 0.079 |

| EO*SDG | 2.088*** | 0.000 | 5.228** | 0.013 |

| IO*SDG | 0.146 | 0.501 | -0.440 | 0.462 |

| OC*SDG | 3.042*** | 0.002 | -9.857** | 0.020 |

| Market CAP Group | ||||

| Lower-Mid Cap | 4.148*** | 0.000 | -2.803* | 0.098 |

| Small Cap | 12.118*** | 0.000 | 12.643*** | 0.000 |

| Upper-Mid Cap | -0.299*** | 0.006 | -1.201 | 0.554 |

| Very Large Cap | 5.569*** | 0.000 | 4.731*** | 0.006 |

5. DISCUSSION

This study aims to evaluate the impact of SDG-related investment on firm performance with the moderating role of ownership structure. The study collected data from 70 firms in the FTSE 100 index from 2015 to 2024. The study’s findings indicated that SDG is significantly and negatively related to the ROA and positively and significantly related to ROE. These findings are inconsistent with the previous studies, as most highlighted SDGs’ significant and positive impact on ROA and ROE. The study of Shen et al. (2024) has revealed a significant and positive impact of SDGs on financial performance in Chinese firms. The inconsistent findings were due to the differences in sample size, regional context, and industry characteristics. FTSE 100 firms have distinct market dynamics, regulatory environments, and investor expectations compared to Chinese firms, affecting the financial implications of SDG. Similarly, the findings are inconsistent with Saha et al. (2024) study conducted in developed and developing countries. Hence, considering different markets and countries has led to inconsistent findings. Furthermore, the findings are also inconsistent with the studies conducted in Oman (Al Lawati, 2022), Italy (Berreta et al., 2024), and Europe (Kayed & Meqbel, 2025). Hence, the regional differences have led to the inconsistencies. Furthermore, the higher variability of the financial performance and SDG investment of FTSE 100 firms (as shown in the descriptive statistics) has also led to these inconsistent findings. The negative ROA effect could indicate the short-term cost of SDG investment, which would lower asset efficiency. However, the positive ROE effect implies long-term profitability returns fuelled by enhanced brand equity, stakeholder trust, and leverage effects. This indicates how sustainability strategies might tighten operations in the short run but eventually increase shareholder value in FTSE 100 companies. The study findings further elaborate that executive ownership and ownership concentration have a significant and positive moderating role in the relationship between SDG and ROA. In contrast, institutional Ownership has an insignificant moderating role. Furthermore, executive and institutional Ownership have insignificant and positive moderating roles, but Ownership concentration significantly and positively moderates the relation of SDG with ROE. The theoretical justification of the moderating effect of these variables, as provided by (Bashiru et al., 2022; Jan et al., 2021; & Saeed et al., 2025), can be empirically applied to the FTSE 100 firms. The moderating effect can be due to the unique governance structures and market regulations of FTSE 100 firms. However, it is noted that Executive ownership and ownership concentration directly impact firm performance. This implies that for FTSE 100 firms, these ownership characteristics are important for their financial performance but may not necessarily moderate SDG-related investment. The choice of executive Ownership, institutional Ownership, and ownership concentration as moderating variables is based on agency theory and existing research such as (Bashiru et al., 2022; Jan et al., 2021; & Saeed et al., 2025), which supports that ownership patterns determine management choices and company performances. The mixed and sometimes non-significant results, especially for institutional Ownership, emphasise the intricacy of governance mechanisms in FTSE 100 companies. These findings indicate that alternative governance controls, e.g., board composition, independence, and diversity, potentially have a more significant moderating effect. This being said, future research must include more governance variables to address this more fully. The summary of the hypothesis is presented in Table 6 below.Table 6. Hypothesis summary.

| Hypothesis | Accept/Reject |

| H1: SDG-related investment has a significant and positive impact on the financial performance. | Accepted |

| H2: Executive Ownership has a significant moderating effect on the relationship between SDG-related investment and financial performance. | Accepted for ROA, Rejected for ROE |

| H3: Ownership Concentration has a significant moderating effect on the relationship between SDG-related investment and financial performance. | Accepted |

| H4: Institutional Ownership has a significant moderating effect on the relationship between SDG-related investment and financial performance. | Rejected |

CONCLUSION

This research evaluated the effect of SDG investments on firm performance in FTSE 100 firms with a moderator of ownership structure. Results show that SDG investments have a negative and significant relationship with ROA and a positive and significant relationship with ROE. Besides, executive ownership and ownership concentration have a significant and positive moderating role in the relationship between SDG and ROA, while institutional ownership has an insignificant moderating role. Furthermore, executive and institutional Ownership have insignificant and positive moderating roles, but Ownership concentration significantly and positively moderates the relation of SDG with ROE. These findings emphasise regional, market, and governance distinctiveness that influence the financial effect of sustainability in advanced economies. FTSE 100 companies should combine SDG projects with overall strategic objectives to become financially more effective. Ownership structures need to be arranged to capitalise on direct performance advantages. Policymakers and regulators should establish frameworks to stimulate open SDG disclosures and linkages to firm governance. Companies can invest in capacity development to incorporate sustainability more effectively into their core business.LIMITATIONS AND FUTURE DIRECTION

This research centres on ownership structure as a corporate governance dimension, which restricts an inclusive analysis of governance’s contribution to SDG-related financial performance. Other key governance aspects, such as board composition, board independence, CEO duality, and audit committee effectiveness, were excluded. However, they might strongly affect how sustainability initiatives affect firm performance. The exclusion of these dimensions might ignore essential mechanisms through which governance affects SDG integration and performance. Future research must include various corporate governance variables to comprehensively analyse how governance practices interact with SDG investments and impact firm financial outcomes.AUTHOR’S CONTRIBUTION

I.M. has contributed to conceptualization, idea generation, problem statement, methodology, results analysis, results interpretation.CONSENT FOR PUBLICATION

Not applicable.AVAILABILITY OF DATA AND MATERIALS

The data will be made available on reasonable request by contacting the corresponding author [I.M.]FUNDING

None.CONFLICT OF INTEREST

The authors declare that there is no conflict of interest regarding the publication of this article.ACKNOWLEDGEMENTS

Declared none.REFERENCES

Al Lawati, H., & Hussainey, K. (2022). Does disclosure of sustainable development goals affect corporate financial performance? Sustainability, 14(13), 7815. https://doi.org/10.3390/su14137815.

Alshareef, M. N. (2024). Ownership structure and financial sustainability of Saudi listed firms. Sustainability, 16(9), 3773. https://doi.org/10.3390/su16093773.

Attarit, T., Sirimathep, P., Petpairote, W., Jiracheewee, J., & Pestunji, C. (2025). The influences of corporate governance on corporate social responsibility and firm performance of the listed companies in Thailand sustainability investment. International Journal of Economics and Financial Issues, 15(1), 238-245. https://doi.org/10.32479/ijefi.17406.

Bashiru, M., Hashim, F., & Ganesan, Y. (2022). Corporate sustainability performance and firm value: Examining listed Nigerian petroleum companies from Stakeholder and Agency theories perspectives. Global Journal Al-Thaqafah (Special Issue, 13–22). https://doi.org/10.7187/gjatsi022022-2.

Berreta, V., Demartini, M. C., & Trucco, S. (2024). From sustainability to financial performance: the role of SDG disclosure. Measuring Business Excellence, 1-19. https://doi.org/10.1108/MBE-05-2024-0054.

Boshnak, H. A. (2024). Ownership concentration, managerial Ownership, and firm performance in Saudi listed firms. International Journal of Disclosure and Governance, 21(3), 462-475. https://doi.org/10.1057/s41310-023-00209-0.

Bougie, R., & Sekaran, U. (2019). Research methods for business: A skill building approach. (8th Ed.) John Wiley & Sons. https://books.google.com.pk/books?hl=en&lr=&id=ikI6EAAAQBAJ&oi=fnd&pg=PA3&dq=sekaran+and+bougie&ots=tgLZm7EHDi&sig=xp1scHSF3kzxhx8PxIPfDu2w95g&redir_esc=y#v=onepage&q=sekaran%20and%20bougie&f=false.

Casciello, R., Marco M., & Fiorenza M. (2025). Board characteristics and sustainable development goals disclosure: evidence from european state-owned enterprises. Journal of Public Budgeting, Accounting & Financial Management, 37(2), 224-253. https://doi.org/10.1108/JPBAFM-06-2023-0099.

Ceesay, N., Shubita, M., & Robertson, F. (2021). Sustainability reporting practices in ftse 100 companies. In The Sustainability Debate: Policies, Gender and the Media, (pp. 77-100). Emerald Publishing Limited. https://doi.org/10.1108/S2043-905920210000015005.

Chen, S., Wang, Y., Albitar, K., & Huang, Z. (2021). Does ownership concentration affect corporate environmental responsibility engagement? The mediating role of corporate leverage. Borsa Istanbul Review, 21, S13-S24. https://doi.org/10.1016/j.bir.2021.02.001.

Gulzar, S., Sarwar, U., Sattar, S., Usman, M., & Quibtia, M. (2024). Tax audit, tax penalty, religiosity and tax compliance. Journal of Asian Development Studies, 13(3), 776-79. https://doi.org/10.62345/jads.2024.13.3.64.

Habib, A., Oláh, J., Khan, M. H., & Luboš, S. (2025). Does Integration of ESG disclosure and green financing improve firm performance: Practical applications of stakeholders’ theory. Heliyon, 11(4), e41996. https://doi.org/10.1016/j.heliyon.2025.e41996.

Halisçelik, E., & Soytas, M. (2019). Sustainable development from millennium 2015 to sustainable development goals 2030. Sustainable Development, 545-572. https://doi.org/10.1002/sd.1921.

Haris, M., Ahmad, M. A., Hussain, S., Sarwar, U., Zafar, H., & Khan, M. B. (2025). Stimulating online purchase intentions through digitalization: Intermediation of perceptions and electronic word of mouth in fashion e-commerce. Journal of Asian Development Studies, 14(1), 1520-1538. https://doi.org/10.62345/jads.2025.14.1.120.

Jan, A. A., Lai, F. W., Draz, M. U., Tahir, M., Ali, S. E. A., Zahid, M., & Shad, M. K. (2021). Integrating sustainability practices into islamic corporate governance for sustainable firm performance: from the lens of agency and stakeholder theories. Quality & Quantity, 1-24. https://doi.org/10.1007/s11135-021-01261-0.

Javed, M. Y., Hasan, M., Aqil, M., Ziaur Rehman, M., & Salar, S. A. (2024). Exploring sustainable investments: How they drive firm performance in indian private and publicly listed companies. Sustainability, 16(16), 7240. https://doi.org/10.3390/su16167240.

Jiang, Y., García-Meca, E., & Martinez-Ferrero, J. (2023). Do board and ownership factors affect Chinese companies in reporting sustainability development goals? Management Decision, 61(12), 3806-3834. https://doi.org/10.1108/MD-01-2023-0113.

Jibril, R. S. (2024). Women on board, institutional Ownership and emissions disclosure practices as tools for attaining sustainable development goals in Nigeria. International Journal of Disaster Resilience in the Built Environment, 15(4), 728-754. https://doi.org/10.1108/IJDRBE-02-2023-0019.

Kayed, S., & Meqbel, R. (2025). SDG disclosure and financial performance: Evidence from Europe. In Proceedings of the 7th International Conference on Finance, Economics, Management and IT Business,1, 17-28. https://doi.org/10.5220/0013201400003956.

Lassala, C., Orero-Blat, M., & Ribeiro-Navarrete, S. (2021). The financial performance of listed companies in pursuit of the sustainable development goals (SDG). Economic Research-Ekonomska Istraživanja, 34(1), 427-449. https://doi.org/10.1108/JPBAFM-06-2023-0099.

Lin, W. L., Chong, S. C., & Wong, K. K. S. (2025). Sustainable development goals and corporate financial performance: Examining the influence of stakeholder engagement. Sustainable Development, 33(2), 2714-2739. https://doi.org/10.1002/sd.3259.

Meqbel, R., Dwekat, A., & Mardawi, Z. (2025). Ownership structure and sustainability: Insights into SDG disclosures in european firms. Research Square, 1, 1-24. https://doi.org/10.21203/rs.3.rs-5907095/v1.

Montiel, I., Cuervo-Cazurra, A., Park, J., Antolín-López, R., & Husted, B. W. (2021). Implementing the United Nations’ sustainable development goals in international business. Journal of International Business Studies, 999. https://doi.org/10.1057/s41267-021-00445-y.

Naibaho, E. A. B., & Shahab, A. M. (2025). The role of corporate governance mechanism and sustainability reporting in firm performance: evidence on resource-based sectors. Advances in Management and Applied Economics, 15(2). https://doi.org/10.47260/amae/1524.

Necib, A., & Jarboui, A. (2025). Evidence of the effects of ESG (environmental, social, and governance) and rental availability on business value (analysis of businesses in the banking sector of the London Stock Exchange’s FTSE100 from 2020 to 2024). Available at SSRN 5217774. http://dx.doi.org/10.2139/ssrn.5217774.

Qaderi, S. A. (2025). An examination of Malaysian companies’ SDG reporting: does the corporate governance-level mechanisms matter? Measuring Business Excellence. https://doi.org/10.1108/MBE-08-2024-0129.

Saeed, M. M., Mohammed, S. S., Adeniyi, A., & Osei, M. (2025). The impact of corporate governance on the contribution of listed firms to sustainable development goals (SDGs) disclosures in Ghana. Sustainable Development. 33(3), 4676-4688. https://doi.org/10.1002/sd.3367.

Saha, S., Hasan, A. R., Islam, K. R., & Priom, M. A. I. (2024). Sustainable Development Goals (SDGs) practices and firms’ financial performance: Moderating role of country governance. Green Finance, 6(1), 162-198. https://doi.org/10.3934/GF.2024007.

Saleh, M. W., Eleyan, D., & Maigoshi, Z. S. (2024). Moderating effect of CEO power on institutional Ownership and performance. EuroMed Journal of Business, 19(3), 442-461. https://doi.org/10.1108/EMJB-12-2021-0193.

Sarwar, U., Ahmad, M. B., Mubeen, M., Fatima, I., & Rehan, M. (2023). A bibliometric analysis of sustainability disclosure in high polluting industries. Bulletin of Business and Economics (BBE), 12(3), 28-43. https://doi.org/10.61506/.

Sarwar, U., Baig, W., Rahi, S., & Sattar, S. (2025). Fostering green behavior in the workplace: The role of ethical climate, motivation states, and environmental knowledge. Sustainability, 17(9), 4083. https://doi.org/10.3390/su17094083.

Sarwar, U., Bint-e-Naeem, N., Fahmeed, L., & Atif, M. (2024). Role of perceived security and financial attitude in shaping behavioral intention under the moderation of financial literacy. Journal of Asian Development Studies, 13(3), 1380-1395. https://doi.org/10.62345/jads.2024.13.3.112.

Schena, R., De Fano, D., & Russo, A. (2025). Enhancing corporate performance through strategic SDG disclosure: an assessment of depth and breadth of sustainability information. Measuring Business Excellence. 7, 102. https://doi.org/10.1108/MBE-07-2024-0102.

Shafai, N. A., & Abd-Mutalib, H. (2024). Ownership structures and sustainability reporting of Malaysian listed companies. Jurnal Pengurusan, 70, 1-14. https://www.proquest.com/openview/ba3b2d10fa58ccf9d92b291360347ef0/1?pq-origsite=gscholar&cbl=5316522.

Shaukat, M. Z., Yousaf, S. U., Sarwar, U., & Sattar, S. (2024). Thriving in turmoil: Unraveling the interplay of resources, resilience, and performance among SMEs in times of economic vulnerability. Bulletin of Business and Economics (BBE), 13(2), 164-173. https://doi.org/10.61506/01.00312.

Shen, S., Venaik, S., & Liesch, P. (2024). A novel model linking UN SDGs with international experience and firm performance. International Business Review, 33(5), 102170. https://doi.org/10.1016/j.ibusrev.2023.102170.

Talha, M., Saleem, S., Shahbaz, K., Sarwar, U., & Sattar, S. (2025). Investigating financial knowledge driven entrepreneurial intentions: the intermediation of financial knowledge and contingency of risk-taking propensity. Center for Management Science Research, 3(3), 450-469. https://cmsr.info/index.php/Journal/article/view/152.

Truong, T. H. D. (2025). Environmental, social and governance performance and firm value: does ownership concentration matter? Management Decision, 63(2), 488-511. https://doi.org/10.1108/MD-10-2023-1993.

Veeravel, V., Murugesan, V. P., & Narayanamurthy, V. (2024). Does ESG disclosure really influence the firm performance? Evidence from India. The Quarterly Review of Economics and Finance, 95, 193-202. https://doi.org/10.1016/j.qref.2024.03.008.

Velte, P. (2023). Institutional ownership and board governance. A structured literature review on the heterogeneous monitoring role of institutional investors. Corporate Governance: The International Journal of Business in Society, 24(2), 225-263. https://doi.org/10.1108/CG-10-2022-0414.

Wardan, R. Y., & Rizki, A. (2024). The effect of sustainable development goals on financial performance with institutional ownership as a moderating variable. Ekspansi: Jurnal Ekonomi, Keuangan, Perbankan, dan Akuntansi, 16(1). https://doi.org/10.35313/ekspansi.v16i1.5758.

Wu, S., Li, X., Du, X., & Li, Z. (2022). The impact of ESG performance on firm value: The moderating role of ownership structure. Sustainability, 14(21), 14507. https://doi.org/10.3390/su142114507.

Yang, Z., Na, J., & Dong, X. (2024). Corporate governance for sustainable development: A study on mechanism configuration. Journal of Cleaner Production, 458, 142509. https://doi.org/10.1016/j.jclepro.2024.142509.

Yahaya, O. A. (2025). Institutional ownership and firm performance. Available at SSRN 5216573. http://dx.doi.org/10.2139/ssrn.5216573.

Yue, S., Khatib, S. F., Bajuri, N. H., Sulimany, H. G. H., & Lee, Y. (2025). Executive ownership and minority shareholder protection: Drivers of environmental innovation in China’s a‐share market. Corporate Social Responsibility and Environmental Management. 32(3), 3854-3873. https://doi.org/10.1002/csr.3158.

Zioło, M., Bąk, I., Cheba, K., Filipiak, B. Z., & Spoz, A. (2023). Environmental, social, governance risk versus cooperation models between financial institutions and businesses. Sectoral approach and ESG risk analysis. Frontiers in Environmental Science, 10, 1077947. https://doi.org/10.3389/fenvs.2022.1077947.